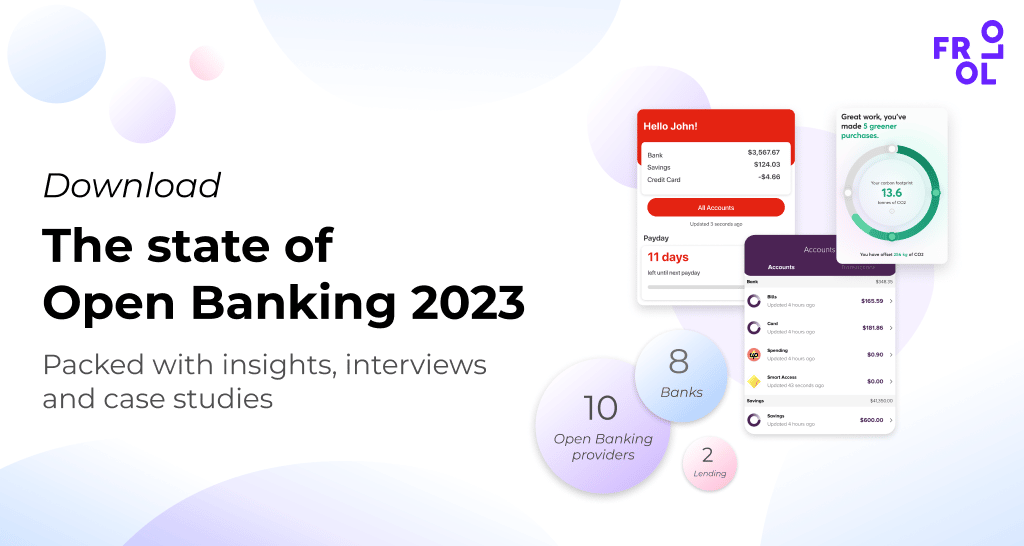

In the State of Open Banking 2023, we take a pulse check of the industry and the opportunities it presents for banks, fintechs, brokers and lenders. In this article, we’ve highlighted our key takeaways.

Open Banking has come a long way since it first launched in 2020, with only the Big Four banks sharing data for a limited number of products. Today, almost all banks are sharing data for over 30 different financial products. And those who’ve signed up to use that data have doubled in the past year.

So, while navigating some bumps in the road, Open Banking is starting to find its feet in Australia. Although the rollout has taken longer than expected, Open Banking now has sufficient coverage as the sole data source for a use case. We’re at a point where Open Banking–powered solutions aren’t just on the horizon, they’re here, and the many benefits of Open Banking are starting to be realised. Businesses can use CDR data to power new, innovative customer experiences. They can turn data into insights that help streamline lending decisions and customer onboarding. And consumers can use those insights to better manage their money. With superior security, transparency, and privacy protections compared to traditional ways of sharing financial data, we’re starting to see the shift away from old and insecure practices, such as screen scraping.

And kinks are being ironed out as the system continues to mature. Tiered accreditation, for instance, has lowered the barrier to entry, and we’re now seeing CDR Representative, Trusted Advisor and Accredited Data Recipient CDR models used by different businesses. Even though Open Banking take-up might not quite be where we hoped it would be by now, that is fast changing.

Data availability and beyond

But there are still some steps to take in the journey towards delivering on its full potential to disrupt financial services and improve the lives of Australians. Now we’ve moved into the ‘go live’ phase of the system’s growth, the determinants of success have shifted beyond the initial roll-out to Data Holders. They now lie in product coverage, user experience, the availability and timely supply of reliable, quality data – and that data being used in innovative, effective and engaging ways.

We are finally sitting on the foundations required to build truly incredible customer experiences.

Christian Westerlind Wigstrom, Monoova

The good news is APIs are lightning-fast and very reliable. With millions of API calls under our belt, we have a significant amount of data to measure performance, and it all paints a positive picture. But that’s not to say it’s a complete picture. An analysis of the shared information shows us there are gaps, with the sharing of ‘optional’ data falling short. And much of the potential of Open Banking relies on the richness of this data.

Sharing data in certain circumstances (such as for joint account holders) hasn’t been as seamless as a robust system demands. But these are fixable problems. More complications will undoubtedly arise, but there is widespread support for continuing to refine and improve the system, with the ACCC, Treasury, Data Standards Board, banks, and businesses all working hard to improve open data capability in Australia. The ongoing challenge for banks and financial service businesses will be keeping up with regulations and keeping pace with emerging data opportunities.

The Open Banking ecosystem must remain supported by focusing on improving data quality and enforcing Data Holder standards for consumer experience and reliability.

Tony Thrassis (Frollo)

The consumer perspective

Consumers want the products and services Open Banking enables. Consumer engagement has been growing steadily, especially in the past six months. So there remains an enormous opportunity for those willing to deliver, building next-generation financial well-being and lending experiences, and better financial products. Open Banking also provides an opportunity to address consumers’ privacy and security concerns. Traditional methods of sharing financial data (such as screen scraping and emailing bank statements) are much less secure, privacy is not protected, and consumers have less control over their data. Open Banking provides a secure, regulated alternative.

And with the expected expansion of the CDR across the finance industry, including non-bank lending, as well as the roll-out into new sectors on the horizon (starting now with the energy sector), Australia’s national data portability scheme is well-positioned to drive innovation, increase competition and deliver real value for consumers.

The CDR will revolutionise the way we understand and use our data, putting consumers in control. It will spur innovative products and services that we can’t yet imagine, while driving competition across the economy.

Kate O’Rourke, Treasury

Many businesses have hit the ground running and are already leveraging the opportunities available through Open Banking. Banks like Beyond Bank and P&N Bank and fintechs like Frollo empower consumers through personal financial management apps. Financial wellness platforms like WeMoney support consumers to pay their debt faster. Technology providers like NextGen are enabling mortgage brokers to streamline the lending application process for their customers. And purpose-led B-Corps like Greener are using Open Banking data to build a new Green Economy.

Open Banking is an unmissable opportunity for businesses across the financial sector to drive profitability by better understanding customer needs and using these insights to retain customers and engage new ones with innovative product offerings.

This article is part of ‘The State of Open Banking 2023’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry, interviews with thought leaders and an overview of exciting new use cases.