It’s worth remembering that the CDR is a cross-sector, economy-wide reform. That means we can expect much more from it year after year, even if the current roadmap for the regime isn’t quite clear. The CDR is set to be much bigger than Open Banking and Open Energy, with many potential future sectors, including government and health data. But while we wait for the government to outline the CDR’s strategic direction and timeframe for further expansion, we can take a closer look at those currently on the roadmap – Open Finance and Action Initiation – and what opportunities they might bring.

Open Finance

The bigger picture

Three years in and with over 100 banks in Australia already sharing data for more than 30 financial products, it’s fair to say the CDR gives us pretty good coverage of consumer finances. According to the Treasury, 99.73% of household deposits are covered.

Yet, when it comes to the bigger picture of a consumer’s financial situation, there’s a dark spot of missing information. One of the key datasets currently not covered by the CDR is credit taken out with non-bank lenders. And that’s where Open Finance comes in. Open Finance will extend data-sharing rules to non-bank lenders, including mortgage providers, short-term credit providers and Buy Now Pay Later providers over a certain size.

Treasury has now released a design paper proposing to extend the CDR to cover the non-banking sector. Product data sharing is proposed to start in November 2024, with the rollout for all Data Holders completed by November 2025. The change is expected to give consumers a better understanding of their financial position when making big decisions.

What’s the use (case)?

Adding non-bank lenders to the CDR helps to complete the financial picture required for the most popular Open Banking use cases – lending and money management. And it’s a reasonably significant part of the market. Non-bank lenders account for 5% of the Australian financial system, and 43% of Australians say they’ve recently used a Buy Now Pay Later service. Providing credit or money management services requires a complete view of a customer’s finances, and Open Finance gets us one step closer.

Action Initiation

A new era of CDR

What we have in the Consumer Data Right today is called ‘read access’ to data. It’s essentially one-way traffic, allowing an accredited user to see financial or energy data, analyse it and provide insights or services using this information. But that’s where their authority ends.

The next step in giving consumers control of their data is Action Initiation, write access. As the name suggests, it will allow authorised third parties to take action on their customer’s behalf. This action could include things like making payments or opening or closing accounts.

Although Action Initiation is on the cards, it’s early days yet, so exactly what it will look like is hard to say. Consultations have only recently started, and the government has said it will take until the end of 2024 to develop a framework.

In the meantime, we can explore how it might best work for industry and users. A project by the Data Standards Board to prove an Action Initiation use case – in which Frollo and several others are participating – is one of the initiatives to help develop the framework.

We can also look at the final report from the Inquiry into the Future Directions for the Consumer Data Right commissioned by the government. It highlighted a number of potential use cases that give a clear indication of how transformative Action Initiation could be.

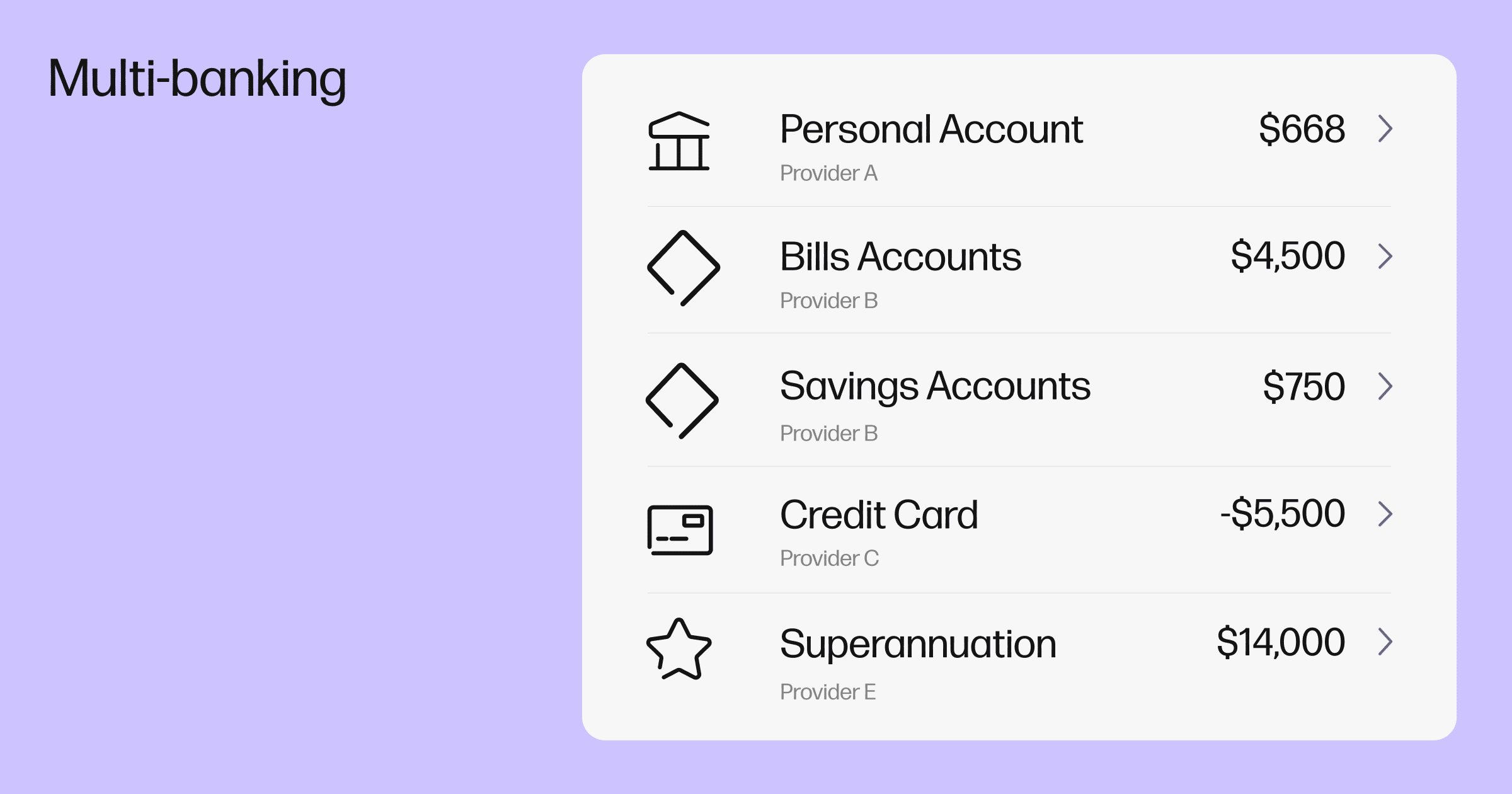

Multi-banking

Payments is the most obvious and talked about use case for Action Initiation in Australia. And we only have to look at the UK to see why. Open Banking there is reshaping the financial and payments landscape at a rapid pace. In July 2023, total monthly payments surpassed 11.4 million, an almost 10% jump on the previous month and double that of the previous year. The numbers represent the convenience, efficiency and simplicity that open banking has brought to managing personal finances.

What might this look like in Australia? Here’s a simple and very possible example. Currently, a bank like Virgin Money Australia can use Open Banking to let customers see all of their finances in the VMA banking app – including accounts they hold with other financial institutions. Where Open Banking payments could take this efficiency one step further is by enabling customers to make payments from, say, their CBA account, within their VMA app.

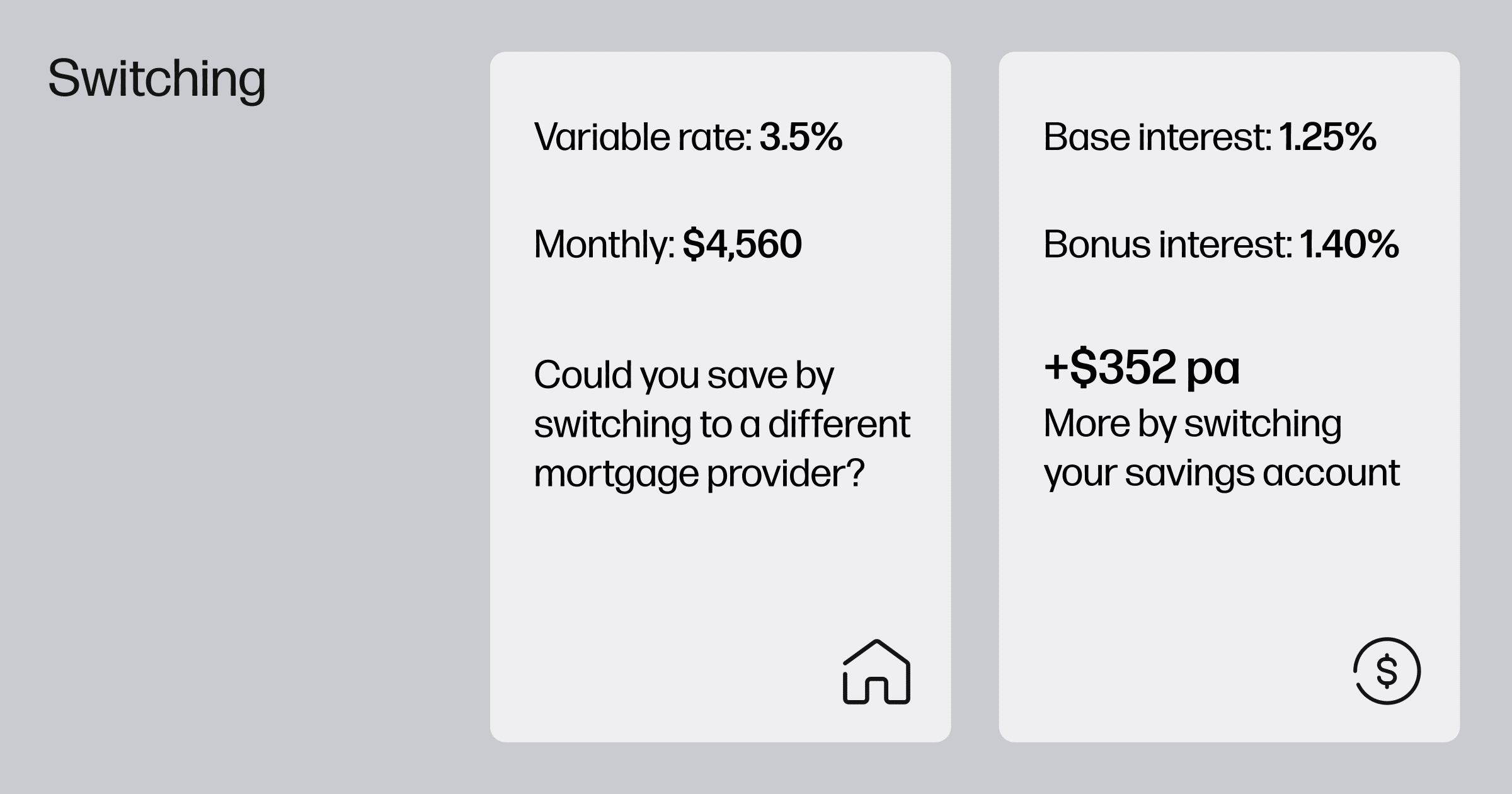

Switching

Switching is the use case the government most often talks about when it comes to the benefits of the Consumer Data Right. It’s one thing for financial comparison websites like Canstar to show users they could earn more on their savings by switching to a different account, but it’s another to let them switch in just a few clicks. Without Action Initiation, it’s still a slow process of finding a new provider or product, and then manually making the switch (and all the admin work that goes along with that). Using Action Initiation, the customer could make the switch immediately after identifying a better product for them and even instruct a third party like Canstar to move their savings across and close their old savings account.

In response to the report, the government said it would prioritise third-party payment initiation and extending CDR to support consumers to switch to new products and services.

This article is part of the State of Open Banking 2024, an industry report by Open Banking provider Frollo, providing a pulse check of the Consumer Data Right, its participants and consumer uptake.