CDR was never meant to be about just banking, so as the roll-out of Open Banking came to a close, a new roll-out began. In October 2022, Open Energy commenced, making Australia the first country in the world with a multi-sectoral Consumer Data Right. Similar to the banks before them, energy companies are required to let customers share their own data with Accredited Data Recipients to get more tailored, competitive services.

The roll-out

Early days

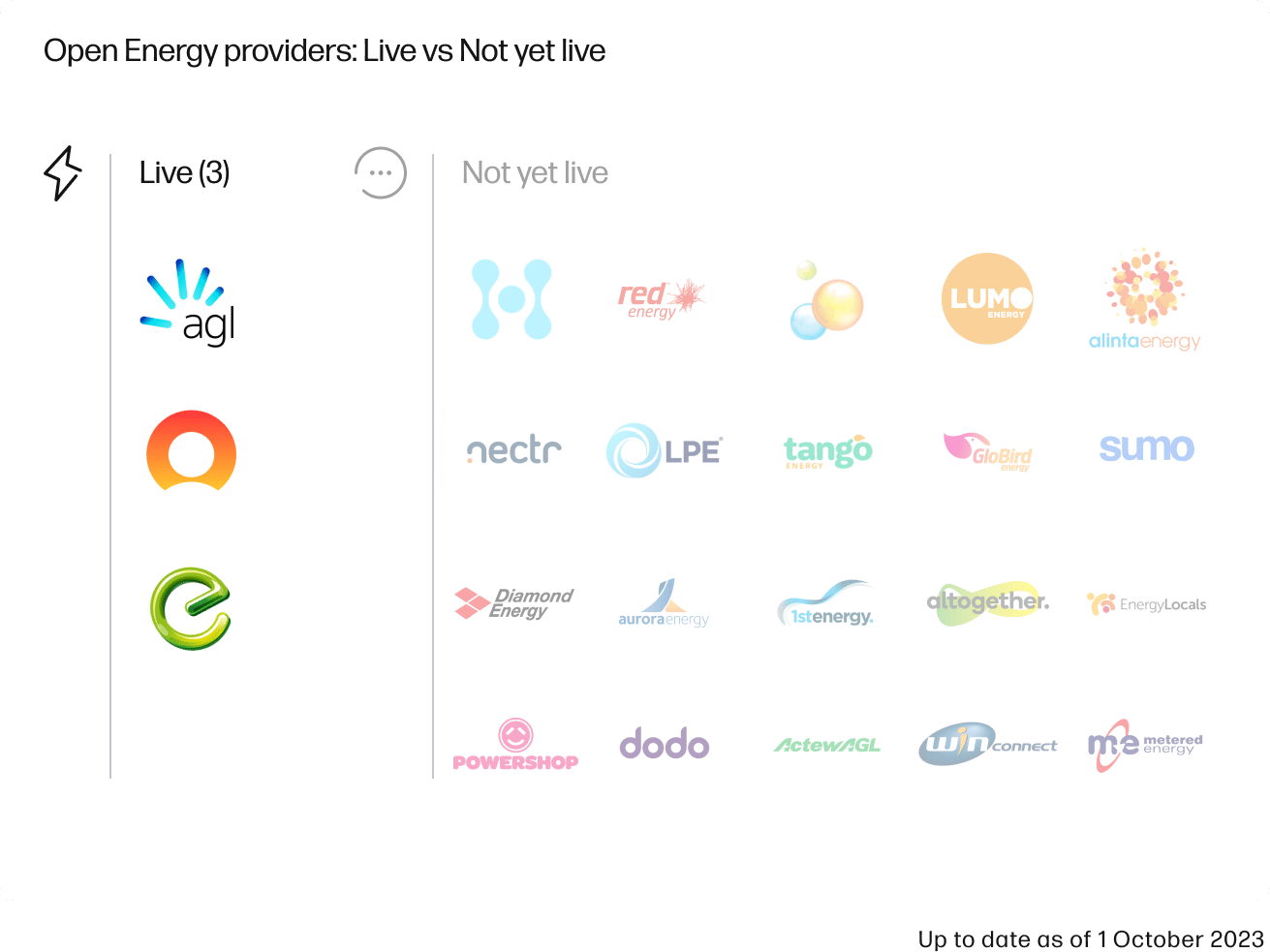

Like the Open Banking roll-out before it, Open Energy is being initiated in stages. It commenced with the sharing of Product Reference Data in October 2022, followed a month later by consumer data-sharing for the Australian Energy Market Operator (AEMO), who works in the background to manage electricity and gas systems and markets across Australia, along with ‘initial retailers’ – the big players in the market including the AGL Energy Group, Origin Energy Group and Energy Australia Group.

Consumer data sharing for ‘larger retailers’ (more than 10,000 customers) commences in November 2023, along with smaller retailers (less than 10,000 customers) that sign up to CDR. Smaller retailers actually won’t have Data Holder obligations unless they become accredited as Data Recipients or wish to participate voluntarily as Data Holders.

More than 20 additional retailers are expected to become available in November 2023 as part of the ‘Large retailer’ group, covering roughly 89% of the NEM customers. These retailers include Red Energy, Powershop, Dodo and Alinta Energy.

Ergon will follow in July 2024, which will bring the coverage up to 99%.

Use cases

Innovating for a competitive advantage

Although it’s still early days for Open Energy, there are some potentially interesting use cases. Much like Open Banking, there is an opportunity to make use of both product and consumer data to provide better outcomes for consumers.

Comparison and switching

The most talked about use case is comparison and switching. Once all of the Data Holders are live, consumers can share their data with a third party. Using usage data and considering things like peak tariffs, feed-in tariffs and other things that are hard to compare manually, they can compare rates and actual potential cost. This should result in a more accurate comparison, helping consumers to make better choices about what would best suit their needs.

The next step in the process is to enable consumers to seamlessly switch to a new retailer or plan once the comparison is done – although that isn’t currently on the CDR roadmap. But once Action Initiation (which gives consumers the ability to instruct an accredited business to act on their behalf) is rolled out to the energy sector, switching should be quicker and easier for consumers.

Energy insights

Just like energy usage varies from consumer to consumer, so does the source – and it’s often more than one. Many Australians now have an energy mix that consists of electricity from the grid, solar and a battery. As more households feel the pinch of rising power bills, making sense of this mix and finding optimisations offers significant potential for savings beyond simply switching (although that can be part of it).

Solar Analytics is the first business in the energy space using CDR to help consumers make smart energy choices and save with a subscription-based product that helps solar panel owners manage and optimise their home energy.

By analysing data directly from a user’s solar panels, as well as from their energy provider (using CDR usage data and detailed tariff data), they can look at all tariff types and find the best plans that suit a customer’s energy consumption behaviours. They use this to determine the best mix of energy plan, battery and/or solar panels for their customer’s situation. But it doesn’t stop there. They then continue to monitor their customer’s energy usage to find optimisations and also warn customers about issues with their setup.

This article is part of the State of Open Banking 2024, an industry report by Open Banking provider Frollo, providing a pulse check of the Consumer Data Right, its participants and consumer uptake.