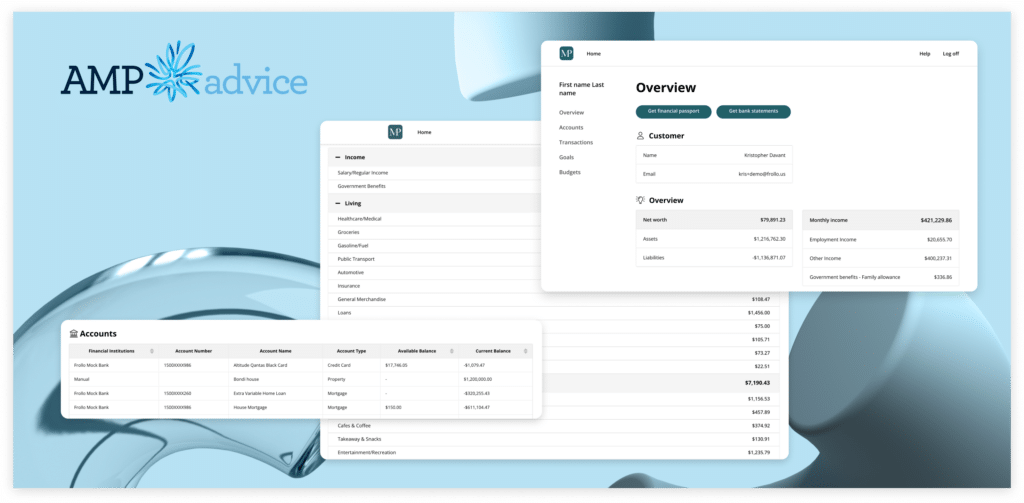

In May 2023, AMP launched its Open Banking powered ‘Money Management Service’ in the AMP Advice network. The solution empowers financial advisers, mortgage brokers, accountants and their clients with Open Banking data.

The service helps practices streamline the advice process by using Open Banking to collect financial information from their clients and provide ongoing additional value through a practice-branded money management app.

The service consists of two key elements:

The Money Partner app

A practice-branded app that provides market-leading money management features to clients.

The Money Partner Portal

A real-time overview of a client’s consolidated banking, including categorised income & expenses and details of loans.

Streamlining the advice process

The Money Management Service helps practices streamline the advice process in three key areas:

- Onboarding new clients

Clients can easily, securely and instantly share their financial data via the practice-branded app. This provides a superior user experience and saves advisers and their clients time.

Advisers are also able to see each of their client’s financial products, including rates and fees, to help them uncover advice opportunities.

And, with the click of a button, they can download a CDR bank statement for use in credit applications.

- Delivering ongoing value to clients

The app gives clients a full overview of their banking, smart money insights and tools to help them manage their money day to day.

Advisers can add the financial goals they’ve set with their clients so their clients can track their progress in the app. - Advice reviews

Collecting financial data for yearly advice reviews is easier than ever, as advisers can access an up-to-date financial overview of their clients in the AMP Partner Portal whenever they need.

Advisers can also download an easy-to-understand Financial Passport PDF to help them walk their clients through their financial situation.

This case study is part of ‘The State of Open Banking 2024’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry and an overview of exciting new use cases – some of which are Frollo clients, some of which aren’t. AMP is a Frollo client.