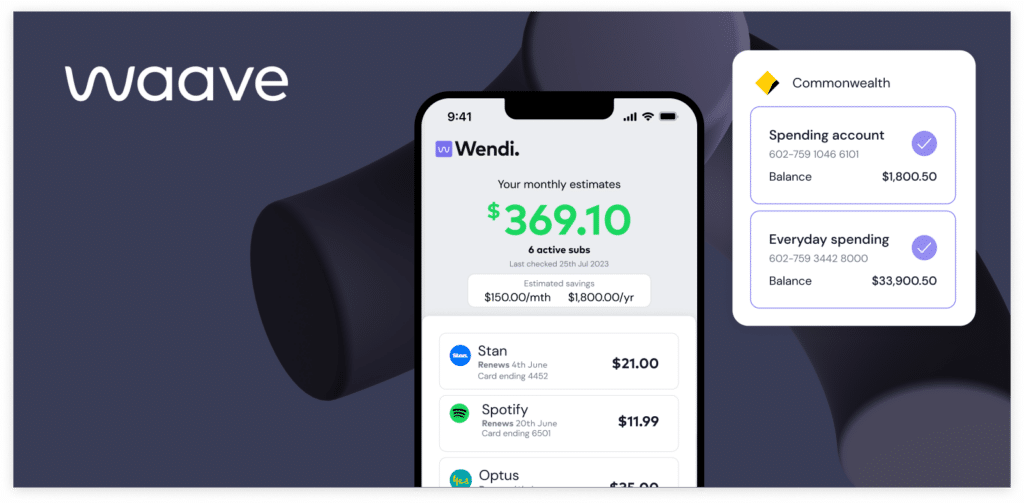

Waave is the first both B2B and B2C payment platform use case of Open Banking in Australia and an accredited intermediary of the Consumer Data Right. Its flagship product, Pay by Bank, is a seamless and secure alternative payment method to traditional cards, allowing customers to pay instantly, directly and securely via their bank, without the surcharge.

Direct debits are a low-cost payment option – much cheaper than cards and BNPL. However, the process has typically been clunky and prone to errors.

For merchants, Pay by Bank is up to 80 percent cheaper than card payments, while providing instant and secure authorisation, faster funds settlement, and no dishonour charges or chargebacks.

Pay by Bank works as follows:

- When customers reach the checkout page on a merchant website, they can select ‘Pay by bank’.

- They register with Waave and link to their bank using Open Banking.

- When they arrive back on the checkout page, they can pay using their linked bank account by simply clicking the payment button.

- Waave creates a direct debit using the details from the linked bank account.

The value of Open Banking

There are a number of key benefits of using Open Banking in this solution:

- Accuracy: The process of creating a direct debit is clunky and prone to errors, as customers have to look up their account details and manually type them in. Pay by Bank uses Open Banking to securely and automatically verify a customer in a few clicks.

- User experience: The first time a customer uses Pay by Bank, it will take them a few minutes to register and link their accounts. The 12-month data sharing permission means that the next time they ‘Pay by Bank’, they don’t have to go through this process again. They can just select Pay by Bank.

- Transparency: Pay by Bank shows customers their account balance in the checkout process, so they can see if they have sufficient funds to make the payment, giving full transparency to the customer.

- Security: Using Open Banking to create a direct debit provides significant security benefits over sharing credit card details with the merchant directly.

This case study is part of ‘The State of Open Banking 2024’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry and an overview of exciting new use cases – some of which are Frollo clients, some of which aren’t. Waave is not a Frollo client.