By Tony Thrassis – Head of Open Banking and Regulatory Affairs (Frollo)

We launched Open Banking in the Frollo consumer app almost four years ago, on 1 July 2020. Since then, we’ve worked with major banks, lenders, brokers and financial advisers, providing them access to Open Banking data. This experience gives us a unique vantage point on the state of data access and quality in the financial services industry.

As part of our ongoing effort to contribute a data-backed perspective to the conversation about Open Banking in Australia, we regularly research API performance, data quality and other aspects of the Consumer Data Right (CDR).

Our latest research analyses the availability of data required for a comprehensive, high-value Open Banking use case: money management. This approach ensures that improvement efforts deliver tangible benefits to consumers and businesses alike rather than being general across all data with limited practical application.

The Money Management Use Case: The Foundation for Impactful Financial Experiences

Money management is a comprehensive use case that draws upon many different data points to provide a full view of a customer’s financial life.

We’ve identified 65 relevant and useful data points for a comprehensive money management use case. These data points span transaction details and product information, including merchant names, category codes, interest rates, credit limits, and loan terms.

By focusing on the data requirements of the most valuable financial experiences, we can drive meaningful improvements that deliver tangible benefits to consumers and businesses.

Tony Thrassis, Head of Open Banking and Regulatory Affairs (Frollo)

Achieving this level of data richness is crucial for enabling advanced money management features like accurate categorisation and personalised insights. It also lays the foundation for delivering better outcomes across many other use cases, ranging from lending and customer onboarding to financial planning and payments.

Open Banking Data Quality: Recommendations For Meaningful Improvements

Product information and account data are the foundation of many financial wellness features, from financial insights and nudges to product comparisons and financial forecasting.

First, we examined the data points most crucial for these high-value use cases across seven of Australia’s largest financial institutions: Commonwealth Bank, Westpac, NAB, ANZ, Bankwest, Macquarie, and ING. These banks collectively account for most personal banking relationships in Australia.

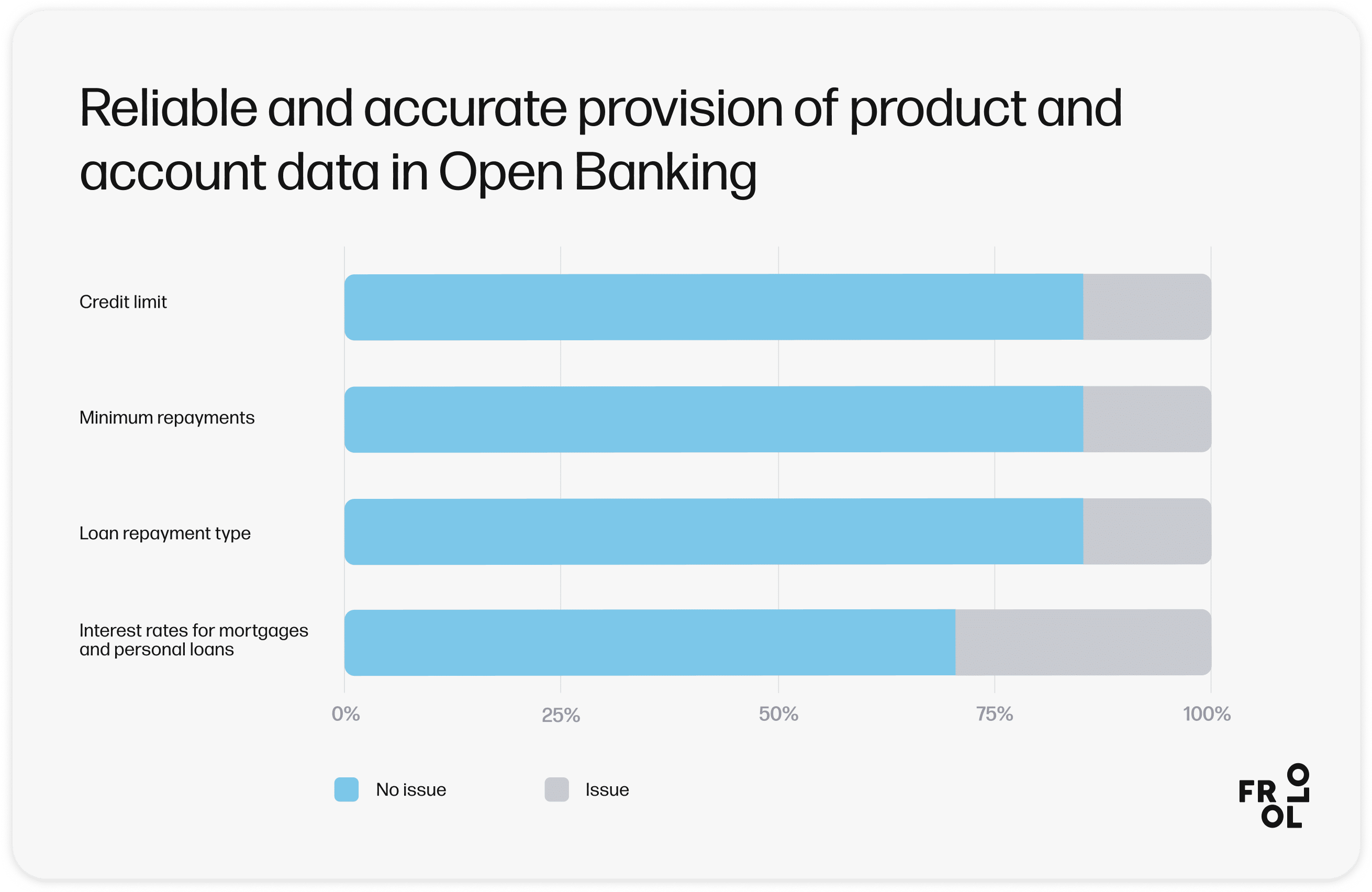

We found that:

- Credit limit was provided consistently by six of the seven banks (86%).

- Six of the seven banks consistently provide minimum repayments for liabilities, with one bank only providing this information 89% of the time.

- Six of the seven banks consistently provided information on loan repayment type (interest only vs. principal and interest), with one exception that only provided this information 82.5% of the time.

- Five of the seven banks (71%) provided interest rates for mortgage and personal loan products without issue, while two banks failed to specify the type of interest rate.

Second, we examined the availability of rich transaction data for all Open Banking participating banks, analysing 210 Million transactions between July 2023 and March 2024.

Reliable and comprehensive transaction data, such as merchant names, category codes, and transaction types, are crucial for an impactful money management experience. They enable accurate categorisation, intelligent insights, and personalised recommendations.

In many areas, Data Holders consistently provide high-quality data. However, our analysis uncovered some areas for improvement.

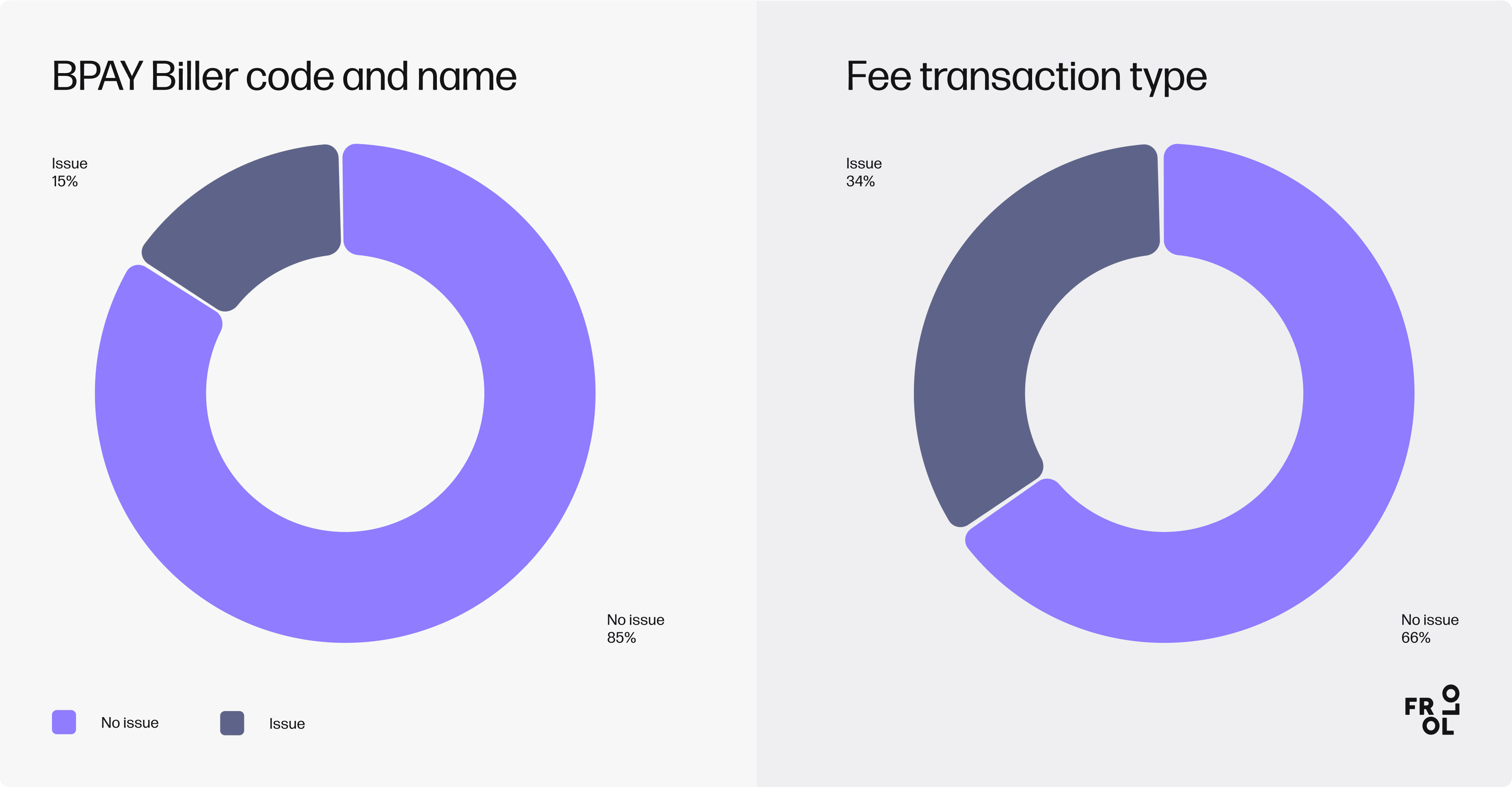

- 15% of BPAY transactions were missing the biller code and name, which are crucial for accurate transaction categorisation and enrichment.

- 34% of fee transactions were not properly categorised as fees, but instead marked as another transaction type.

- 41% of banks overuse the ‘other’ transaction type, labelling more than 20% of transactions as ‘other’ instead of using the standardised transaction types like ‘payment’, ‘transfer’, ‘fees’, ‘interest’ or ‘direct debit’. Some banks even label 100% of transactions as ‘other’.

- Transaction descriptions don’t always appear in Open Banking the way the consumer would see them in their online banking. In those cases, banks use uninformative descriptions like ‘POS PURCHASE’, ‘AUTHORISATION’, or ‘PAYMENT’ instead of the actual merchant name or transaction detail.

These findings underscore the importance of a use case based approach to enhancing Open Banking data quality. By focusing on the data requirements of the most valuable financial experiences, we can drive meaningful improvements that deliver tangible benefits to consumers and businesses.

Open Banking vs. Screen Scraping: A Clear Advantage

Although Open Banking provides a more secure, privacy-friendly, and faster way to share financial data than screen scraping, the quality and availability of data are crucial factors for businesses when making the choice between the two.

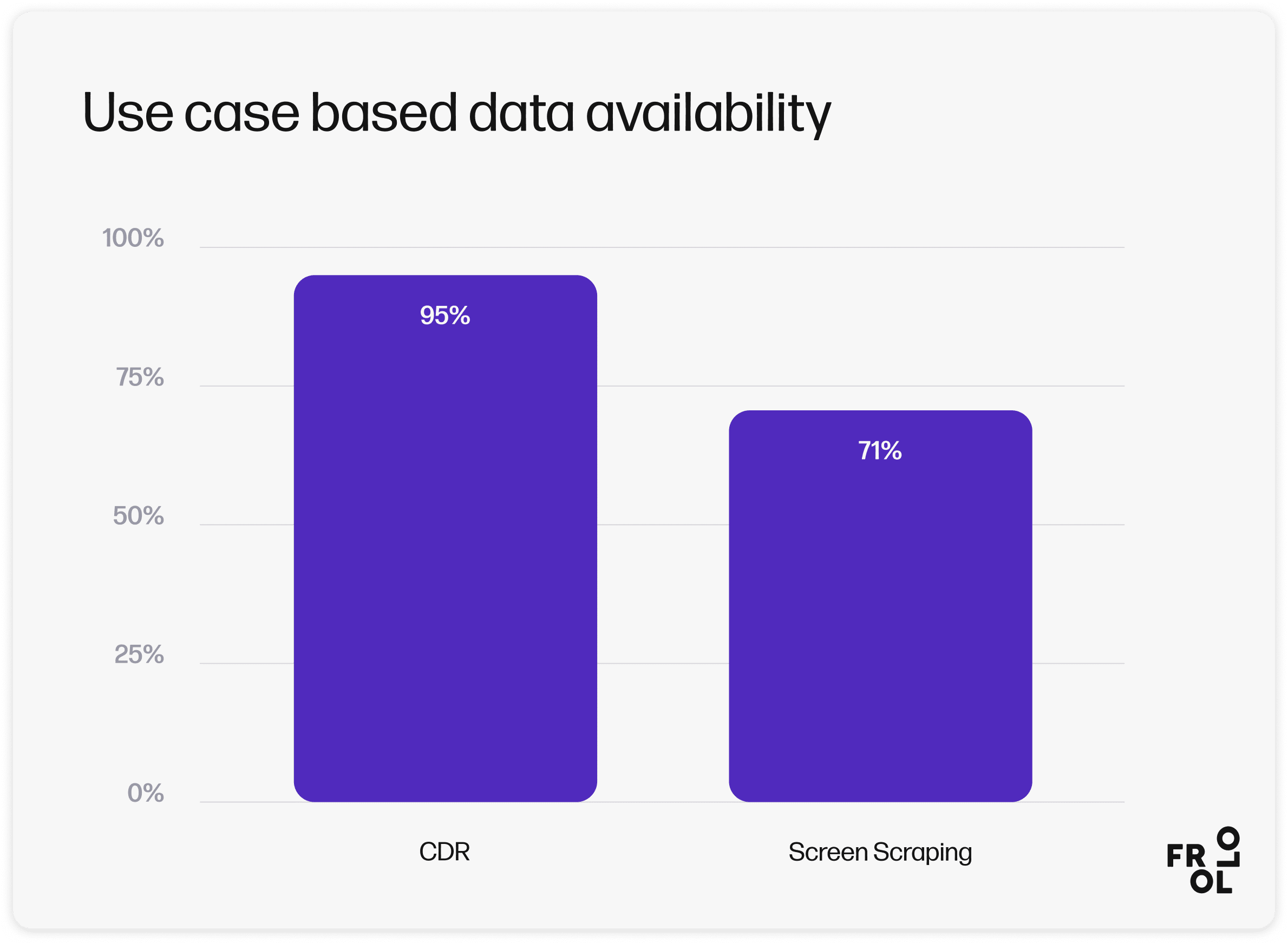

Our use case based analysis found stark differences when we compared Open Banking and screen scraping: Out of the 65 data points we identified as valuable for a comprehensive money management use case, only 49 (71%) were potentially available via screen scraping. In contrast, a remarkable 95% of the data was accessible through Open Banking – a 35% uplift in data coverage.

This difference can be attributed to the fundamental differences between screen scraping and API-based data sharing (Open Banking). APIs make it easier to share rich metadata that may not be directly visible on the user interface but is valuable for businesses. This type of metadata would not be accessible through screen scraping, as it is limited to the information directly displayed on the customer’s screens.

Even data that is theoretically available via screen scraping has its challenges; Data is often provided in inconsistent formats, if available at all. Reliability and consistency can vary significantly between banks, making it challenging to build robust, scalable solutions.

Improving Open Banking: A Collaborative, Use Case Based Approach

As the Open Banking ecosystem evolves, we must approach its development with a clear, user-centric focus. Rather than being general across all data with limited practical application, we must identify the most impactful use cases and work collaboratively to address the specific data gaps and quality issues that hinder their realisation.

By aligning the efforts of the ACCC, the Data Standards Body, and industry participants around these high-value use cases, we can ensure that Open Banking fulfils its promise of transforming the financial services landscape.

We will continue to share our expertise and advocate for this collaborative effort through a use case based approach to improvement, leveraging our unique insights to drive meaningful progress.

Get in touch to discuss how Frollo can help your business deliver a more streamlined, personalised customer experience with Open Banking.