As known drivers of innovation in financial technology, fintechs were widely expected to be the first to take advantage of the Consumer Data Right to build new and innovative products and services.

From the start, it seemed like a natural fit. The ACCC even ran Open Banking trials with a group of 10 fintechs to help build and test the Open Banking rails before it launched in July 2020 (while at the same time building out their own use cases).

There were high hopes for fintech innovation all around, but reality hasn’t quite matched expectations. Or at least it hasn’t yet.

Uptake

Slow out of the blocks

In what has been a shock for many in the industry, there was hardly any fintech uptake in the first two years of CDR. Aside from the Frollo money management app, not many fintechs made the switch to Open Banking data.

However, that did change with the introduction of the CDR Representative model in February 2022. Becoming an ADR is a lot of work. The new model significantly lowered the barrier to entry for fintechs, who could now rely on the accreditation of an Accredited Data Recipient without having to go through the costly and time-consuming process of getting accredited themselves.

It’s no wonder the CDR Representative model is currently the most popular model for participating in Open Banking. And it’s brought a large number of fintechs into the CDR ecosystem. But it’s hard to say how many of these fintechs are live with CDR use cases, as most of them also use screen scraping. In fact, screen scraping has largely contributed to the slow uptake of the CDR by fintechs.

Despite the privacy, reliability and security issues with screen scraping, it has long been the data collection method of choice for most fintechs. It doesn’t require any accreditation, and it lacks regulation. You can collect the data for as long as you want, use it for whatever you want, and keep it long after the consumer has left your business. It offers fintechs pretty much total freedom – and that’s naturally hard to beat, unless the alternative is truly superior. Looking at the many, many use cases now supported, and the quality of the data available, it can finally be argued that CDR is.

Use cases

A long list of possibilities

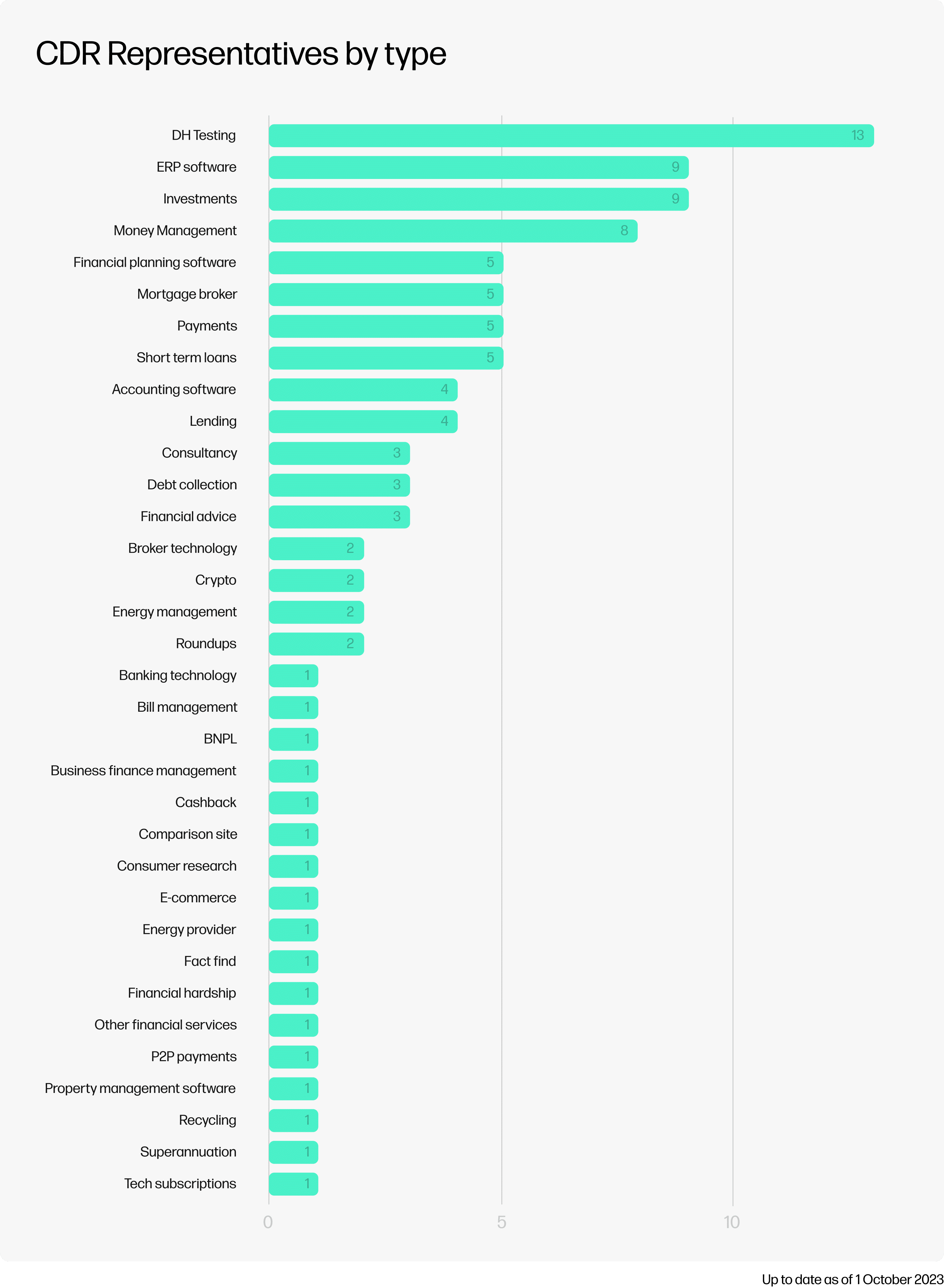

We’ve identified 34 different use cases currently registered as CDR Representatives. Not all of those are fintechs, but most of them are. And that makes the fintech use case landscape much more diverse than any of the others. It’s not surprising, given the diversity in their businesses. Here, we look at 4 of the bigger ticket use cases for fintechs.

Investments

In the past five years, auto-investing has increased in popularity as an easy way to take the thinking out of saving yet see results. Many fintechs offer investment services that rely on rounding up your daily transactions and investing this money in exchange-traded funds (ETFs) or other products. Open Banking enables them to keep track of your transactions and calculate the correct amounts to be invested.

ERP software

Enterprise resource planning (ERP) is a type of software system that helps organisations automate and manage core business processes – such as accounting and resource management – for optimal performance. CDR can help make complex tasks easier while reducing repetition and human error.

Money management

As personal finances are getting more and more complicated, many fintechs are offering tools to manage those finances. The Frollo app, for example, lets users see all of their finances in one place, provides insights to help them understand their financial situation and offers tools to improve.

Payments

Open Banking can help streamline payments for businesses and consumers. Its uses throughout the transaction range from checking balances before debiting an account to checking account name and number (to ensure a payment goes to the right person).

In action

Smart innovations as a competitive advantage

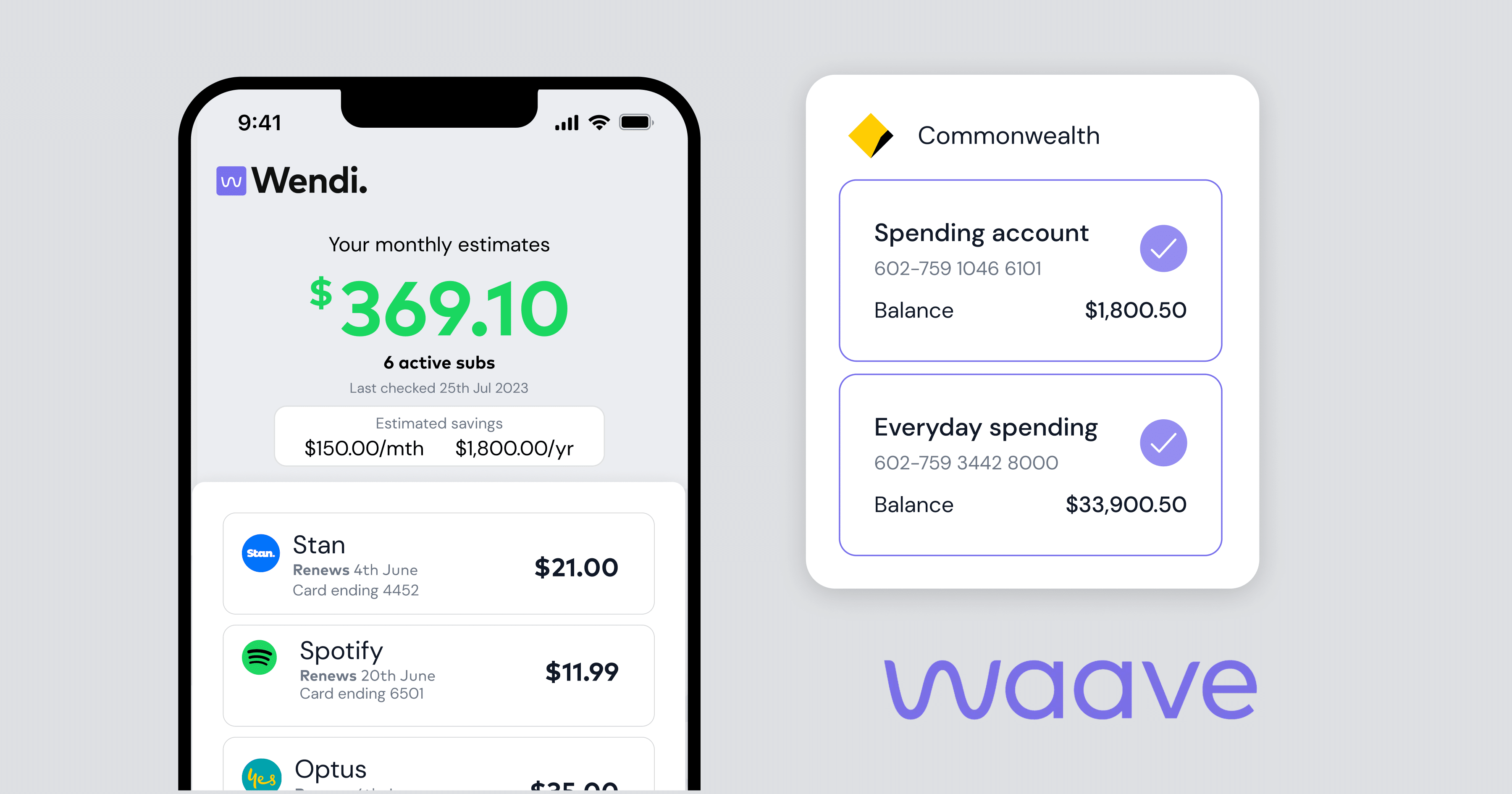

Waave

Waave uses Open Banking data to provide consumers with an innovative way to pay. With ‘Pay by bank’, online merchants can offer customers an alternative way of paying, essentially by direct debit. But customers don’t have to manually type in their debit card details (making it more secure and saving them time). Instead, the direct debit is created using data collected by CDR – BSB, account number and name. It’s quick and easy for customers while helping merchants avoid the higher fees charged by the likes of Visa and Mastercard – a win-win.

Learn more about how Waave uses Open Banking

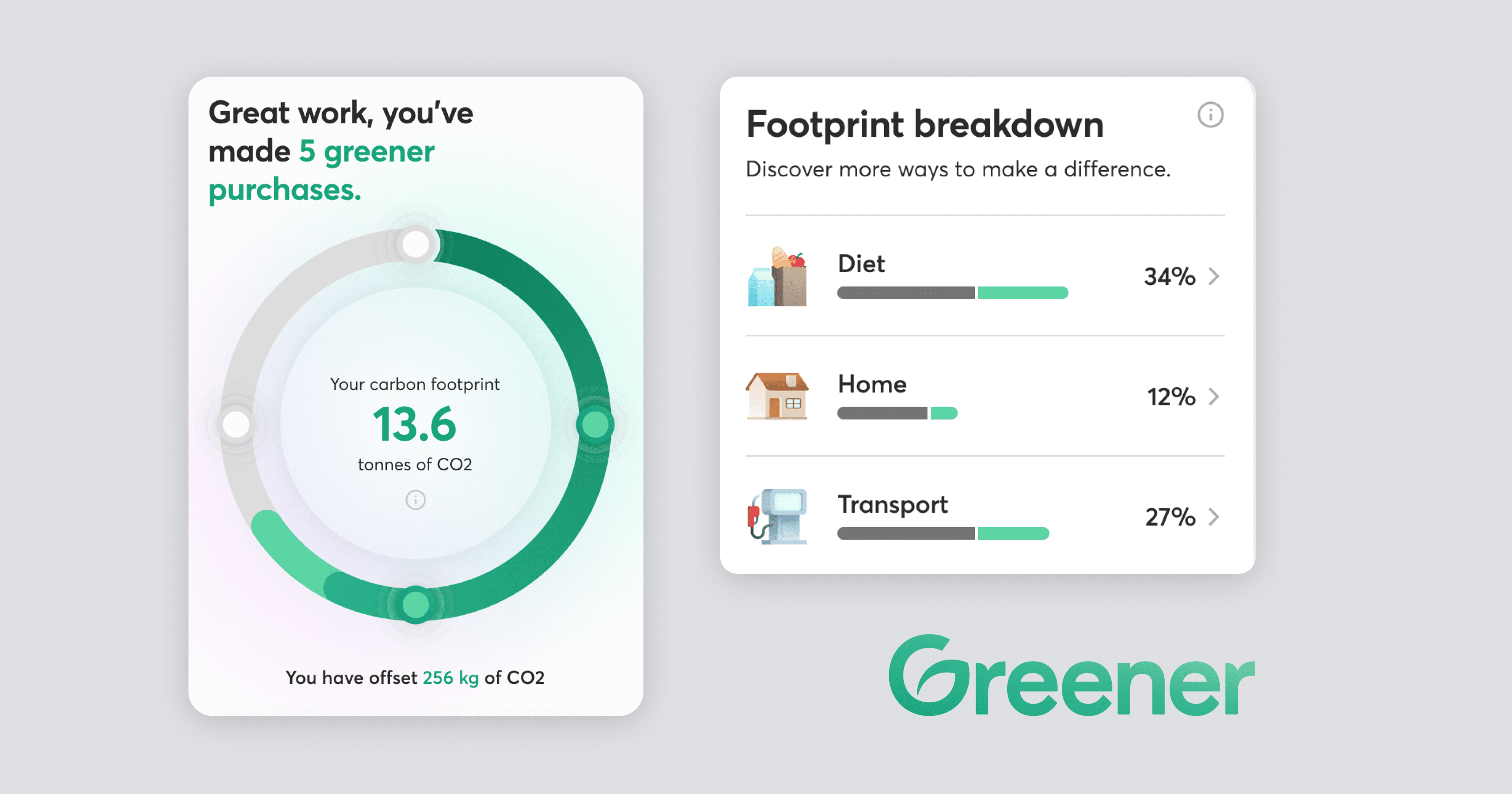

Greener

The Greener app makes it easy for consumers to reduce their impact by empowering them to make green choices when they shop. Greener uses Open Banking data to track and measure the carbon emissions of every dollar they spend and then report this to its users – helping them understand their carbon emissions and guiding them to make informed spending decisions that reduce their overall climate impact. Customers also have access to member-only offers that make it even easier for them to further reduce their carbon footprint.

Learn more about how Greener uses Open Banking

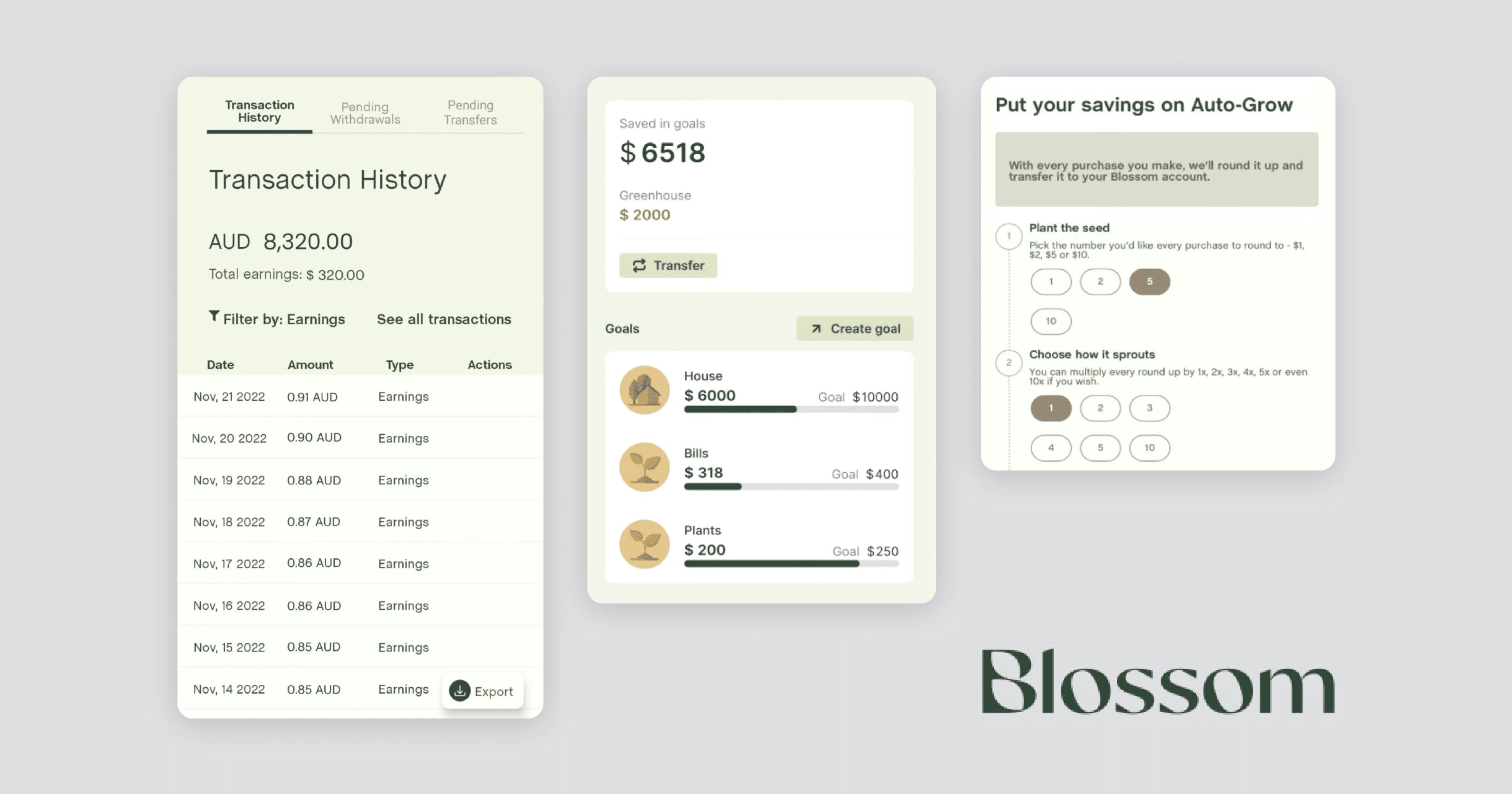

Blossom

Blossom is an investment app that allows customers to invest in a fixed-income fund with a portfolio of cash, semi-government and government bonds, mortgage-backed securities and more. To grow its return faster, it uses Open Banking data to power the round-up functionality of its auto-grow feature. Every time a customer makes a purchase with their linked bank account, they round it up to the nearest nominated $1, $2, $5 or $10 (as chosen by the customer). The ‘change’ is then added to the customer’s investment.

This article is part of ‘The State of Open Banking 2024’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry and an overview of exciting new use cases – some of which are Frollo clients, some of which aren’t. Waave, Greener and Blossom are not Frollo clients.