In the State of Open Banking 2023, we take a pulse check of the industry and the opportunities it presents for banks, fintechs, brokers and lenders. In this article, we look at the roll-out of Open Banking to date.

Data availability and beyond

The Open Banking rollout to Data Holders is nearly complete; product coverage has grown, accessing data is becoming easier, and data is being delivered reliably and at speed. However, there remains room to grow, and improvements are necessary to unlock the full potential of Open Banking.

A new focus for Data Holders

Two and a half years into the CDR, we’re finally at a point where data availability, quality, speed and reliability are at a level that offers banks, fintechs and lenders a great opportunity to deliver engaging use cases. For Data Holders, the initial hard yards of complying with CDR regulations to enable consumers to share their financial data with third parties (and all that entails) are done. Their focus now shifts to ongoing compliance and consideration of the nature of the data they supply.

(Almost) complete coverage

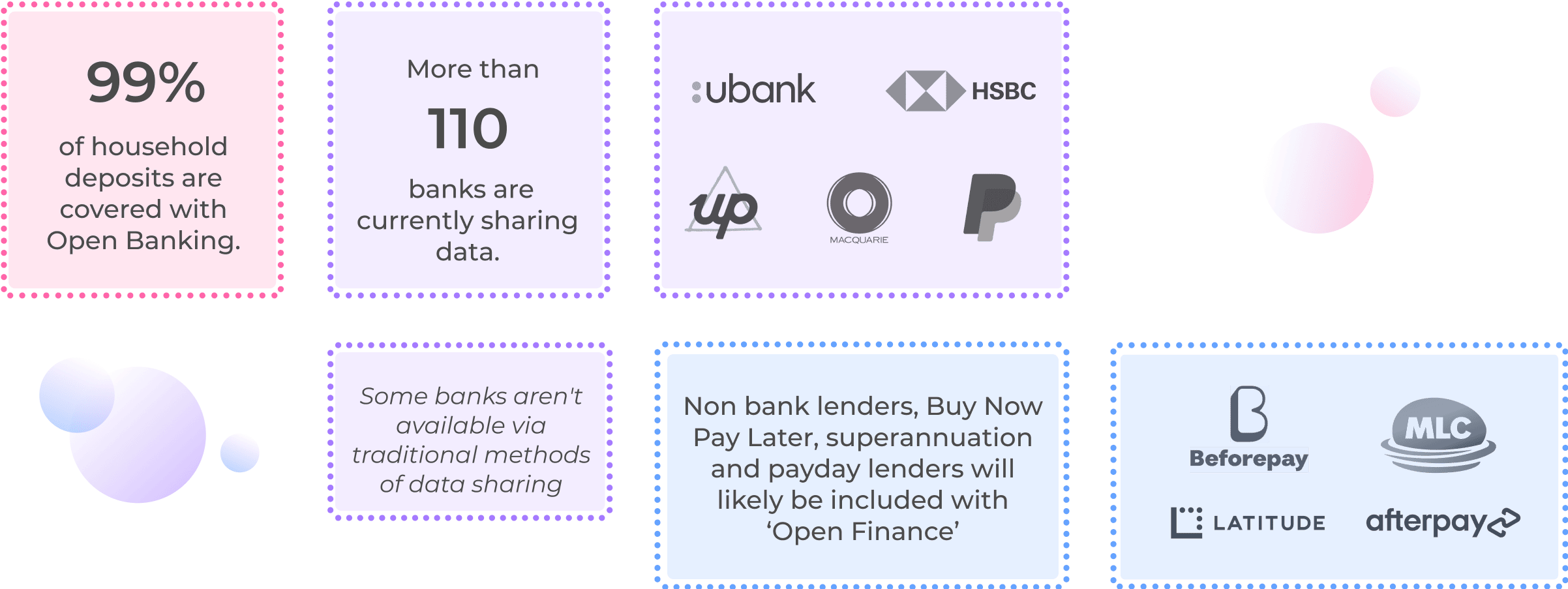

As of 1 November 2022, 114 Australian banks are sharing data for more than 30 different financial products. These products include credit cards, transaction accounts, savings accounts, mortgages and business accounts. It also includes joint accounts of these products. With almost all Australian banks registered as data holders, more than 99% of household deposits is now covered under Open Banking.

Only a few banks aren’t active for data sharing yet:

- BNK

- Greater Bank

- Police Bank

But being registered as active Data Holders on the CDR registry doesn’t mean consumers can connect to their data.

Once a Data Holder is activated, Data Recipients (like Frollo) establish a connection with them, generally through an automated process. After a connection with a Data Recipient has been established, a Data Holder can test (with real customer data) if everything works in production. Frollo works through this ‘Production Verification Testing’ with individual banks, resolving connection, syncing, and data quality issues.

Over 100 banks are now available on Frollo’s Open Banking platform.

While open banking started in July 2020, implementation has been steady, with staggered timeframes for sharing different types of data. Now, most Australian banking consumers can benefit from the CDR, with nearly 100% of market share covered by CDR data-sharing.

Kate O’Rourke (Treasury)

Fast, reliable and rich data, but mind the gap

With a near complete network of Data Holders now part of the Open Banking ecosystem, it’s an ideal time to take a pulse check of the regime. To deliver on its promise, Open Banking relies not just on the sharing of data, but the quality and immediate availability of that data.

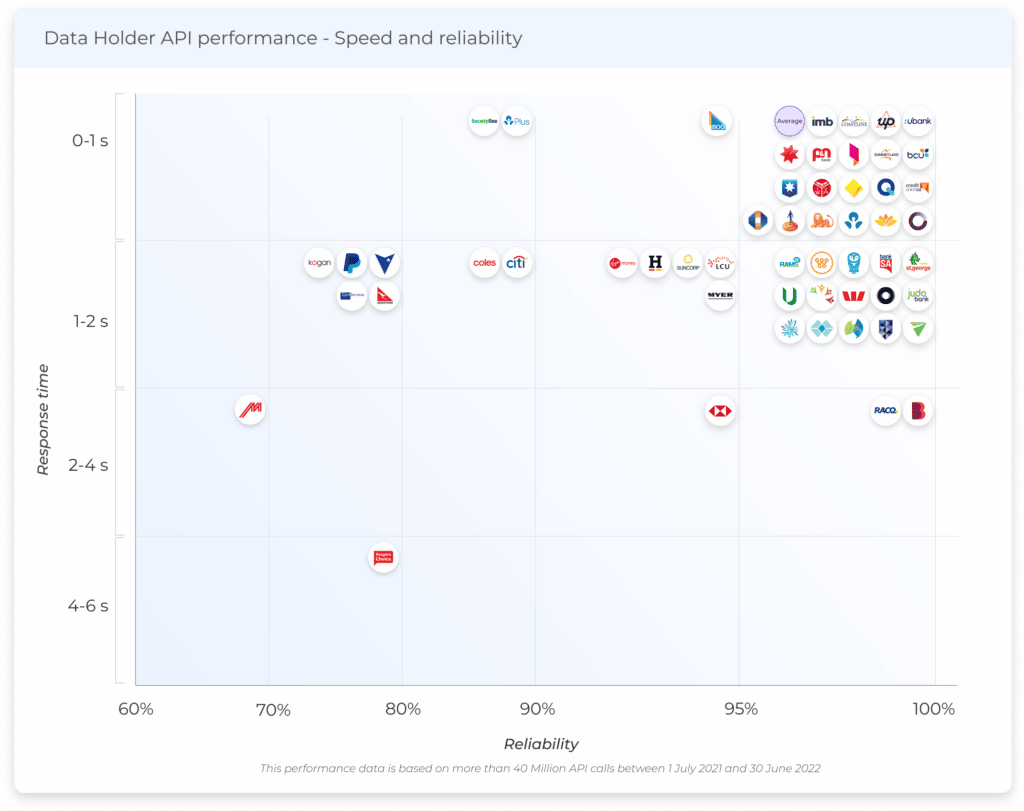

One of the much-touted potential benefits of Open Banking over other ways of getting financial information is that businesses can get it in near real-time. But is that theory true in practice? Frollo has been tracking Data Holder performance for nearly two years, and our data show us yes, it’s true. Although overall speed performance across Data Holders has slowed fractionally as more new participants have come on board – the average response time went from 0.85 seconds in July 2021 to 0.97 seconds in June 2022 – on average, Data Holders provide transactions in less than 1 second. In practice, that’s a near-instant result.

Then there’s the question of reliability. Open Banking is supposed to deliver superior results to alternative data-sharing methods such as screen scraping, where outages, bank security measures and inconsistencies between different online banking interfaces make for a generally unreliable experience. Can consumers rely on Open Banking to share and use their data? Again, yes. Two years in, we’ve found more than 98% of API calls are successful on the first try – with back-off algorithms and other measures ensuring the reliability of Frollo’s Open Banking platform is even higher than that.

There are still issues with consents and user experience, though, and those have to be addressed by the Data Holders and the government.

The CDR also raises the stakes on data quality, promising rich data to enable new use cases and streamline existing ones. Through Open Banking, when the data for a transaction is shared, it can include data that wouldn’t otherwise be available. Aside from the basics such as value, account number, date/time and description, it can also include merchant name, Merchant Category Code (MCC), biller name and biller code.

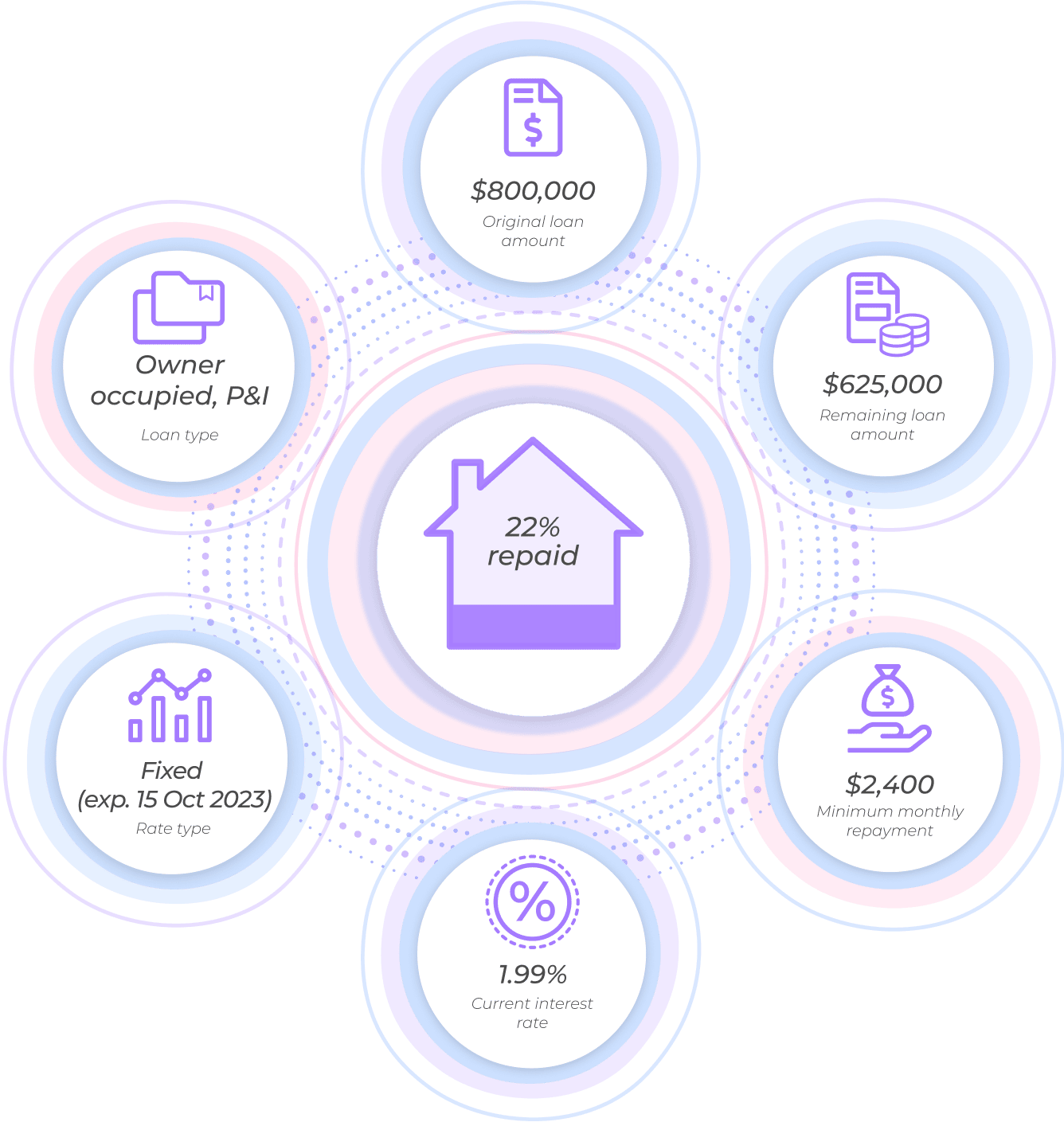

For mortgages, things like the loan origination date and loan amount, minimum monthly repayments and current interest rate are included. This rich data immediately benefits consumers. With this verified data, a consumer can, for example, more easily shop around for refinancing and get more accurate quotes for a new mortgage. They can also get a clearer understanding of their financial situation and habits. For lenders, the availability of this data reduces the administrative burden and financial risk of each loan.

But there’s a gap. For all of this to work, the data has to be available. And looking at the live Data Holders today, that’s only partly true. Data Holders don’t always provide ‘optional’ data in a usable format – if at all.

We analysed the API responses from the top 25 most popular Data Holders to see what kind of payloads we’re getting. In particular, we looked at transaction accounts and home loans. We analysed whether we’re only getting the basic data for money management and lending purposes or rich data we can use for more sophisticated use cases like product comparison, bill management and refinancing.

For transaction accounts, all 25 Data Holders provided all of the basic data – and more. They provide information about the type of transaction, the amount, date and time, description, reference, and even product type and name. However, when it comes to merchant name, Merchant Category Code (MCC), biller code and name, only around 50% of Data Holders provide these for transactions we expect to receive them for. This optional data can improve the accuracy of expense categorisation and enable new money insights.

For home loans, we analysed account data for the top 19 Data Holders. Only the basic properties were supplied by every one of those Data Holders, and they didn’t consistently provide data for:

- interest rate (74%)

- loan end date (84%)

- minimum amount (79%)

- next instalment date (84%).

Although some basic use cases are possible with the data provided, it’s still quite limited from a home loan perspective. The information that could make Open Banking genuinely disruptive in this space was missing.

A current priority is to maintain and improve data quality. As a CDR regulator, the ACCC is working closely with participants on data quality and actively monitoring performance.

Kate O’Rourke (Treasury)

Say goodbye to screen scraping?

In the Frollo Money Manager app, screen scraping is being phased out in favour of Open Banking. To date, screen scraping has been disabled for 21 banks.

An increasing number of banks are also implementing security measures that make screen scraping impossible, including NAB, Macquarie and HSBC, to name a few.

The shift away from screen scraping is also a positive for mobile-only banks, like Up and :ubank (formerly 86:400), that only became available for data sharing through CDR.

This article is part of ‘The State of Open Banking 2023’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry, interviews with thought leaders and an overview of exciting new use cases.