P&N Group is amongst the largest customer-owned banking organisations in Australia, represented by bcu in New South Wales and southeast Queensland and P&N Bank in Western Australia.

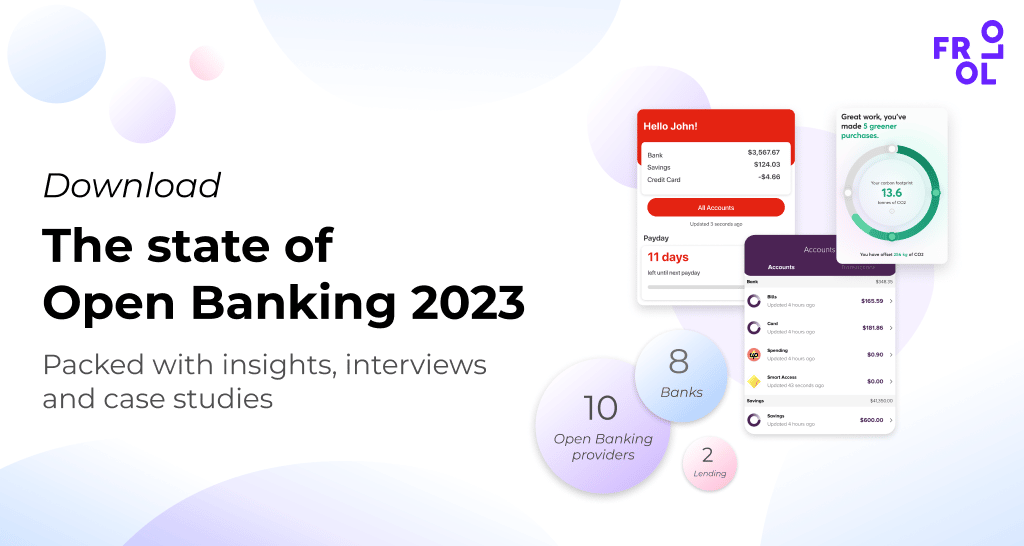

P&N recently launched an Open Banking-powered financial empowerment app, mymo by P&N Bank, for its customers.

Chris Malcolm is responsible for the Group’s data, analytics and Open Banking division.

We believe that Open Banking […] is a revolutionary change in banking and the broader economy.

Chris Malcolm (P&N Group)

P&N Bank is one of the first Australian banks to launch an Open Banking use case. What drove this, and what are you looking to achieve?

We believe that Open Banking, or open data as I prefer to call it, is a revolutionary change in banking and the broader economy – the biggest since digital enablement changed the way customers do their banking.

mymo by P&N Bank is our response to this new opportunity. We believe our use case will genuinely add value to our customers by improving their ability to take control of their finances, budget and accelerate savings, for example a home loan deposit. This will contribute to greater loyalty, thus increasing retention and helping us have richer conversations with our customers. It also means the app is in our customers’ hands now, and they can leverage the benefits while we enhance the features.

P&N Bank is using an end-to-end, integrated solution, where Frollo provides the CDR data as well as the financial well-being app. What were your reasons for this decision?

In short, cost, time and expertise. Frollo’s gateway enables access to the rich information available as part of the open data ecosystem, along with a tangible customer use case, thus allowing us to access this added value. It enables our entry as an Accredited Data Recipient in a cost-efficient manner, given we haven’t had to worry about building and maintaining a CDR gateway, consent management or building the tool itself.

My advice is to partner where possible and very much focus on the use case value.

Chris Malcolm (P&N Group)

Based on your experience so far, what advice would you give other businesses that want to use Open Banking data?

Rightly so, the rules and privacy safeguards are complicated. Working with a partner, such as Frollo, somewhat removes this level of complexity, which has allowed us to focus on the value add to our customers.

My advice is to partner where possible and very much focus on the use case value. In addition, take the view “how does open banking data integrate with the existing corporate strategy and/or value add to existing initiatives and/or pain points” rather than it being a strategy in its own right.

When you look ahead, what would you like CDR to do for your customers in 5 years’ time?

A lot, and I hope it can be achieved in this timeframe.

If you think about the foundational intent of the Consumer Data Right, it’s all about empowering consumers to use their data, for their benefit.

There is very much an opportunity to form up a ‘Digital Life Assistant’ that becomes the go-to, to ensure customers have and continue to have, fit-for-purpose products, services and experiences across banking, telecommunications, insurance and energy.

This would bring additional cash flow and/or savings and debt reduction, delivering better financial and life outcomes for our existing and new customers.

This interview is part of ‘The State of Open Banking 2023’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry, an overview of exciting new use cases and interviews with experts.