Both BNPL and Pay Advance are growing in numbers and average monthly spending.

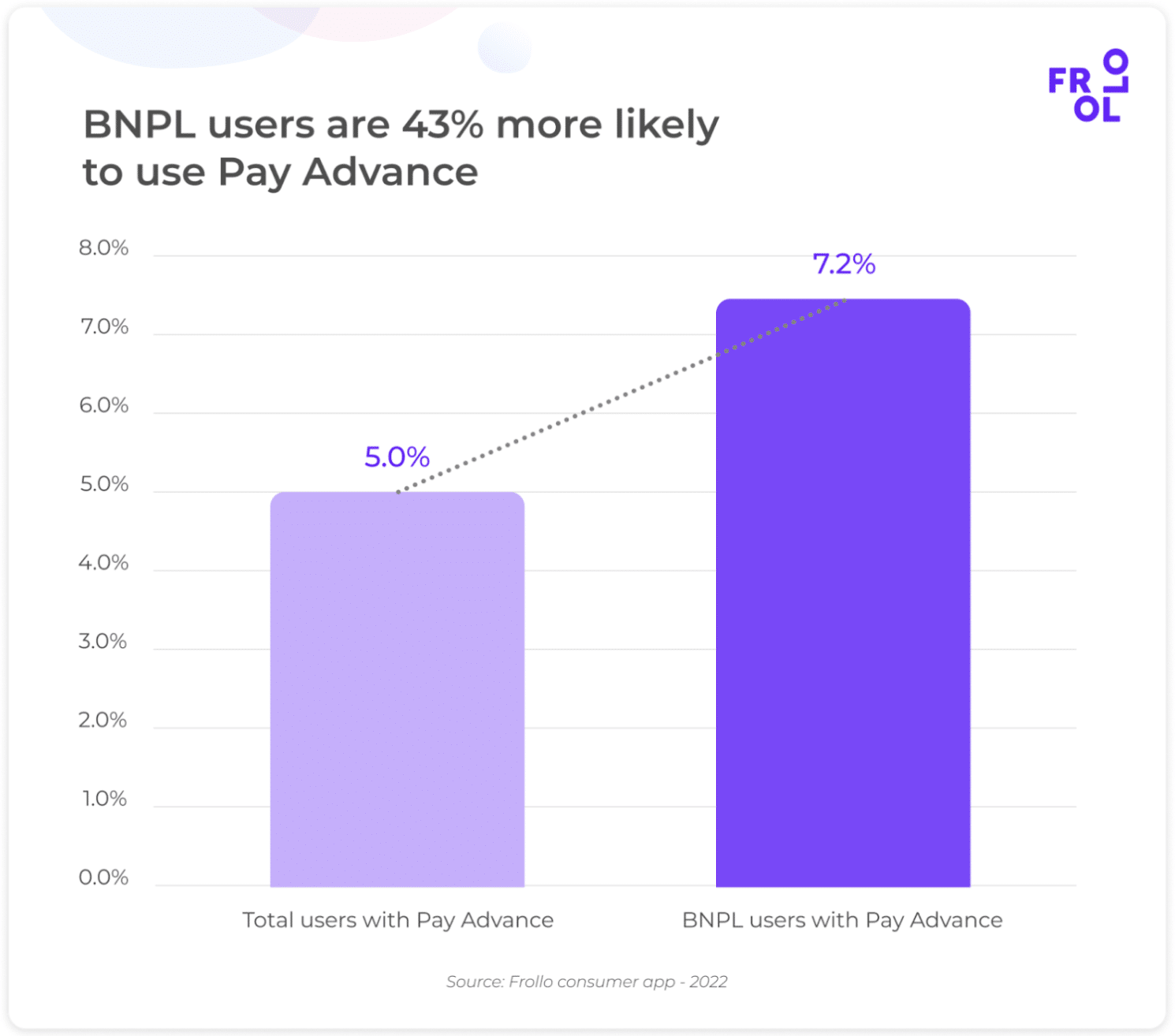

Today we’re publishing new research about Buy Now Pay Later (BNPL) and Pay Advance usage among 33,050 users of our money management app. The research shows that Aussies who use BNPL are 43% more likely also to use Pay Advance services.

Buy Now Pay Later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them at a later date, usually in instalments. BNPL providers include Afterpay, Humm, Zip Pay, CBA StepPay, Klarna, and others

Pay-on-demand services allow users to receive part of their pay right away rather than waiting until payday, subject to interest and upfront and monthly fees. Pay Advance providers include Beforepay, CBA AdvancePay, MyPayNow, Wagetap, and others

Average BNPL spend $439 per month

A closer look at BNPL usage among Frollo users shows that in the months they use BNPL, customers spend an average of $439 on the service, including repayments, fees and penalties.

BNPL use grew throughout 2022 as interest rates increased, and Aussies looked to find solutions amid the rising cost of living. In Q1, Frollo users who used BNPL averaged $417 in spend per month, and this number steadily increased over the remainder of the year, reaching $426 in Q2, $458 in Q3, and $452 in Q4.

The number of people using BNPL grew quarter on quarter throughout 2022, rising from 31.2% in Q1 to 33.4% in Q4. Overall, in 2022 almost half (43%) used BNPL at least once.

Despite the sector facing challenges last year, BNPL remains a regularly used payment option for Aussies. On average, they make 15 BNPL purchases per year, using 1.7 different providers.

Pay Advance usage almost doubled in 2022

Although Pay Advance services aren’t as popular as Buy Now Pay Later, Frollo data shows a significant growth in the usage of these services among Aussies. The number of users with Pay Advance transactions grew incrementally over 2022 from 1.4% in Q1 to 2.7% in Q4. Overall, 5% of Frollo users made at least one Pay Advance transaction in 2022.

On average, Pay Advance customers spent $1,331 on repayments, fees and penalties in 2022. In months they used Pay Advance, their payments averaged $565.

It’s essential to get visibility over this spending to reduce risk and lend responsibly

Simon Docherty (CCO, Frollo)

The need for visibility and education

Frollo’s Chief Customer Officer Simon Docherty explains: “It’s clear from our data that BNPL services aren’t becoming any less important to Aussies, and alongside Pay Advance services, are going to be part of the makeup of the consumer finance landscape for the foreseeable future.

“As a result, there are a few things for lenders to consider. A customer spending $500 per month on Pay Advance services might not be able to afford the same mortgage as someone who doesn’t. So it’s essential to get visibility over this spending to reduce risk and lend responsibly. Both ING and Macquarie have recently announced that they will consider BNPL debts when assessing home loan affordability.

“Unfortunately, lenders can’t rely on credit scores to get the complete picture, as most BNPL debts aren’t registered, and most of these services don’t perform credit checks. New legislation is in the works, but it’s unclear whether this will include reporting obligations.

“Open Banking offers a solution for lenders who want to assess home loan affordability better, manage risk and improve their responsible lending. By analysing customers’ transactions across all their financial institutions, Frollo’s Financial Passport provides a complete view of their income, expenses, assets and liabilities – including BNPL and Pay Advance spending.

“Lenders who want to improve their responsible lending practices, and how they manage risk, should consider using Open Banking data for their credit assessments.”