Currently, 115 banks enable their customers to share data, although few can receive it. However, we should see this change over time as they all have good reasons to want other financial institution data. Completing the financial picture of customers who may only have a credit card or savings account with their bank provides valuable insights. It’s an opportunity for additional and personalised products and services, helping them win more of their customer’s business.

Uptake

Mutual banks leading the way

On 3 October 2023, 10 banks were accredited to use Open Banking data as a Data Recipient, that’s 24% of the 41 ADRs in total. Even though banks make up the largest group of ADRs (along with Open Banking providers – both are 24% of total recipients), there are still only 10 of them. It’s not actually many, compared to the more than 100 banks that are Data Holders and given that banks (as Data Holders) have a quick and easy path to becoming an ADR.

A further 13 were CDR Representatives of another ADR at that point. However, those that became CDR Representatives of another ADR primarily did so for Data Holder testing purposes – not to offer services to customers.

What do these numbers mean in the real world? Despite the apparent interest in using Open Banking data, the reality for consumers is that there are very few opportunities to access Open Banking powered products and services with Australian banks. Most of the banks with ADR accreditations are either not doing anything yet or are running Proofs of Concept. So, Open Banking has a way to go before consumers see the real value of it, although some benefits are starting to come through.

Regional Australia Bank was the first bank to launch an Open Banking use case on 1 July 2020, the day that CDR launched in Australia. The bank started using Open Banking data to streamline its lending process, in a limited capacity.

The Big Four banks soon followed by getting accredited, and there has been talk about launching use cases, but not much has happened. NAB is ahead of the pack since starting to use Open Banking data in its credit card application process in July 2023. That same month, Westpac announced it would start using Open Banking data for its digital mortgages. This all means easier and quicker (and more robust) finance solutions for consumers.

The Commonwealth Bank of Australia has also partnered with our parent company, NextGen, to become one of the first lenders to enable Open Banking for mortgage brokers in NextGen’s loan lodgement platform ApplyOnline. It’s a significant milestone for Open Banking that will redefine the home loan application experience for brokers, lenders, and customers alike.

Interestingly, mutual banks are leading the way with Open Banking use cases, leveraging technology to deliver more for their customers. Beyond Bank launched an Open Banking–powered financial wellbeing app back in June 2022, and P&N Group launched similar apps for its two brands (P&N Bank and BCU).

What consumers want

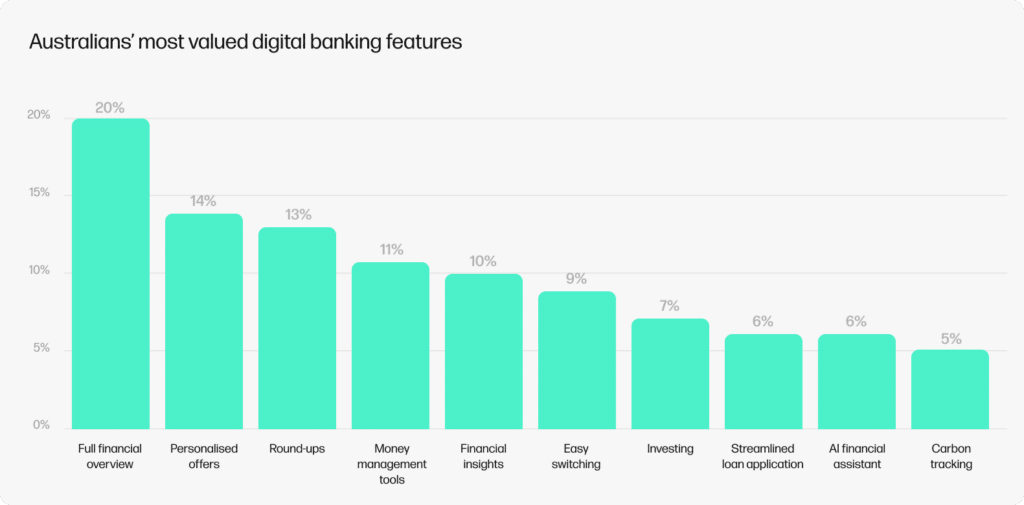

Open Banking is here, but do consumers actually want it? We surveyed over 1,000 Australians, and their answers suggest they do, even if they don’t know it by name. The majority of Australians (55%) have not yet heard of Open Banking, but there is an appetite for Open Banking–powered features.

Here are the key takeaways about what customers want from their financial services.

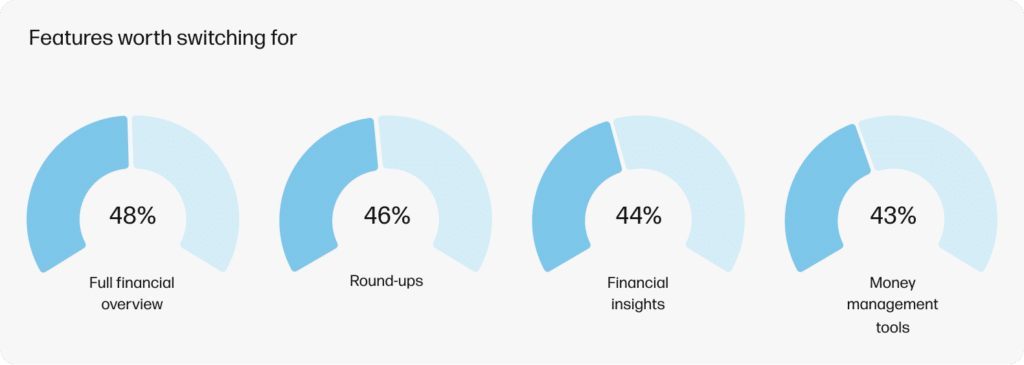

All of their finances in one app

On average, Australians hold financial products with 2.5 different institutions, and getting a holistic view of all their finances in a single app ranked in the top 3 digital banking features for almost half (44%) of customers. And even more (48%) would consider switching to a different bank if it offered this feature.

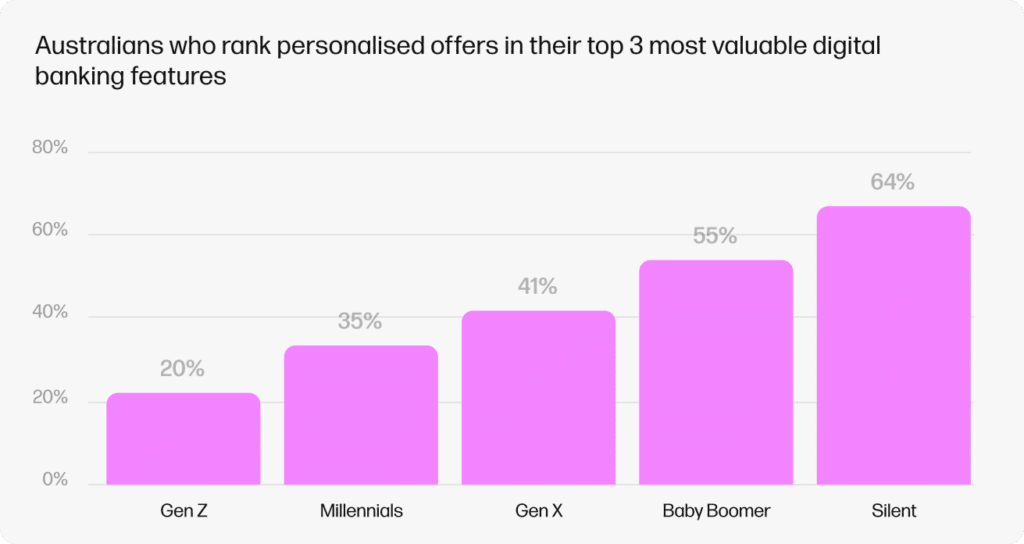

Better deals and personalised offers

Australians want their bank to help them get a better deal on their finances with products and services that are better suited to them.

Young customers will switch for Open Banking

Younger generations are most excited about Open Banking powered features and are most likely to switch to get access.

An easier mortgage application process

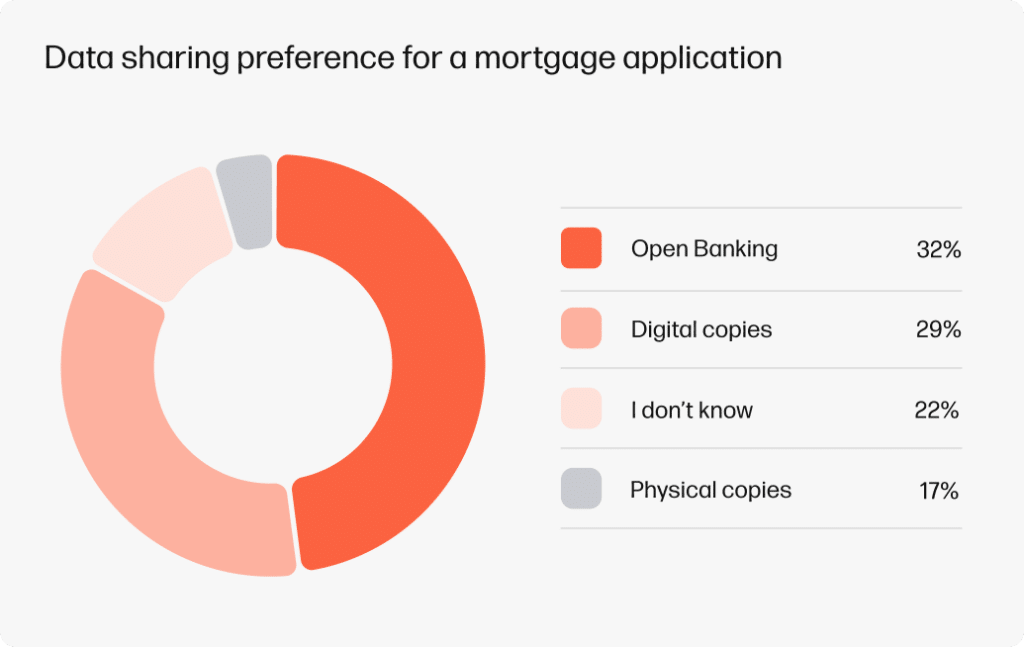

Despite limited awareness, Open Banking emerges as the preferred method of sharing financial information in the mortgage process.

In action

Uncovering real world value

Although there’s still only a limited number of use cases in action, the examples below show how Open Banking is being successfully used to offer consumers better value and service.

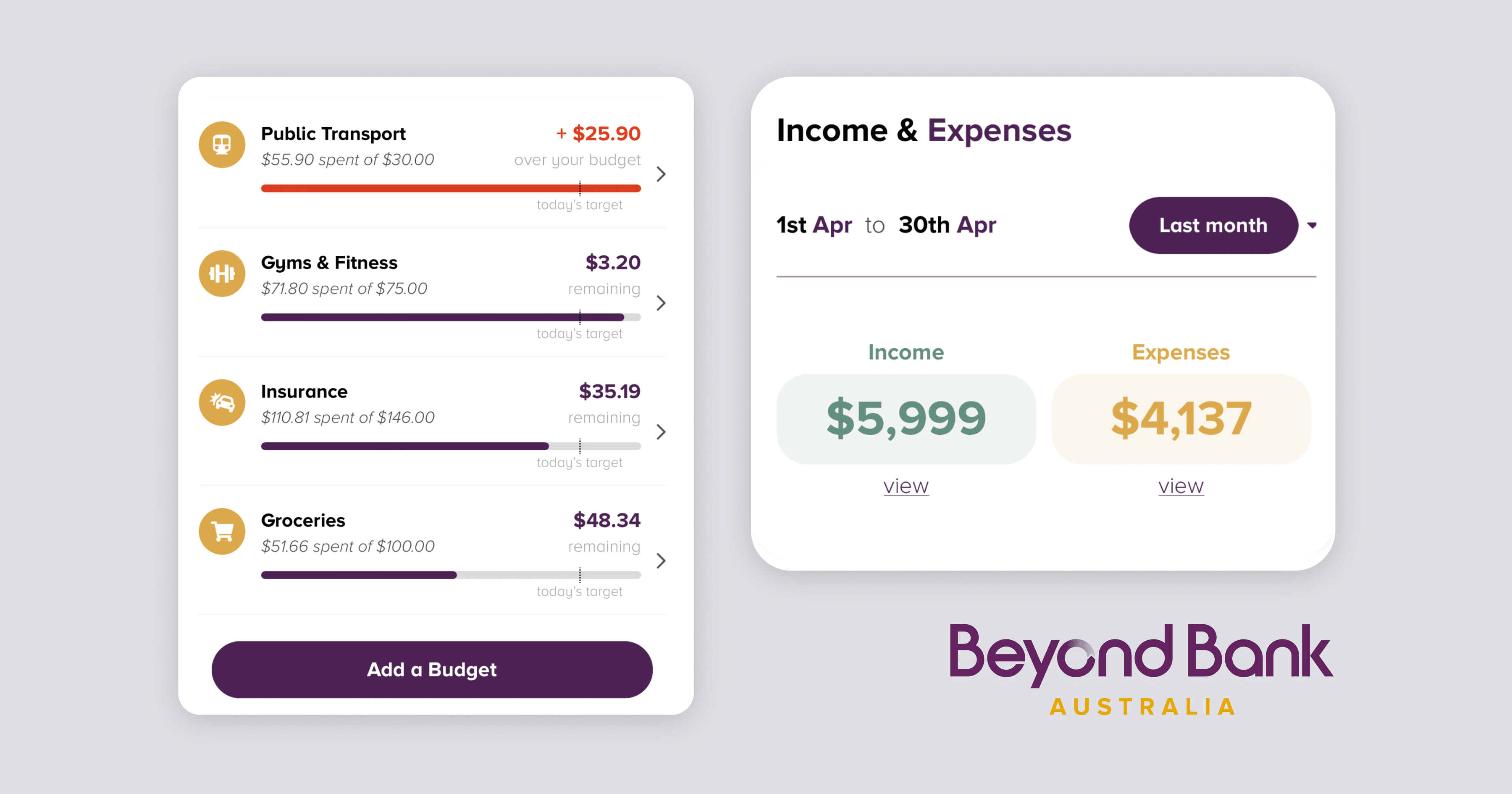

Beyond Bank

Beyond Bank was the first bank to launch a Personal Financial Management app using Open Banking data. The Beyond Bank+ app launched in June 2022 and provides customers with a full view of their finances in one place, including accounts they hold with other financial institutions (using data their customers have authorised to be shared). The Open Banking powered service includes budgeting and tracking tools, making it easier for customers to manage their money and improve their financial wellbeing.

Learn more about how Beyond Bank uses Open Banking

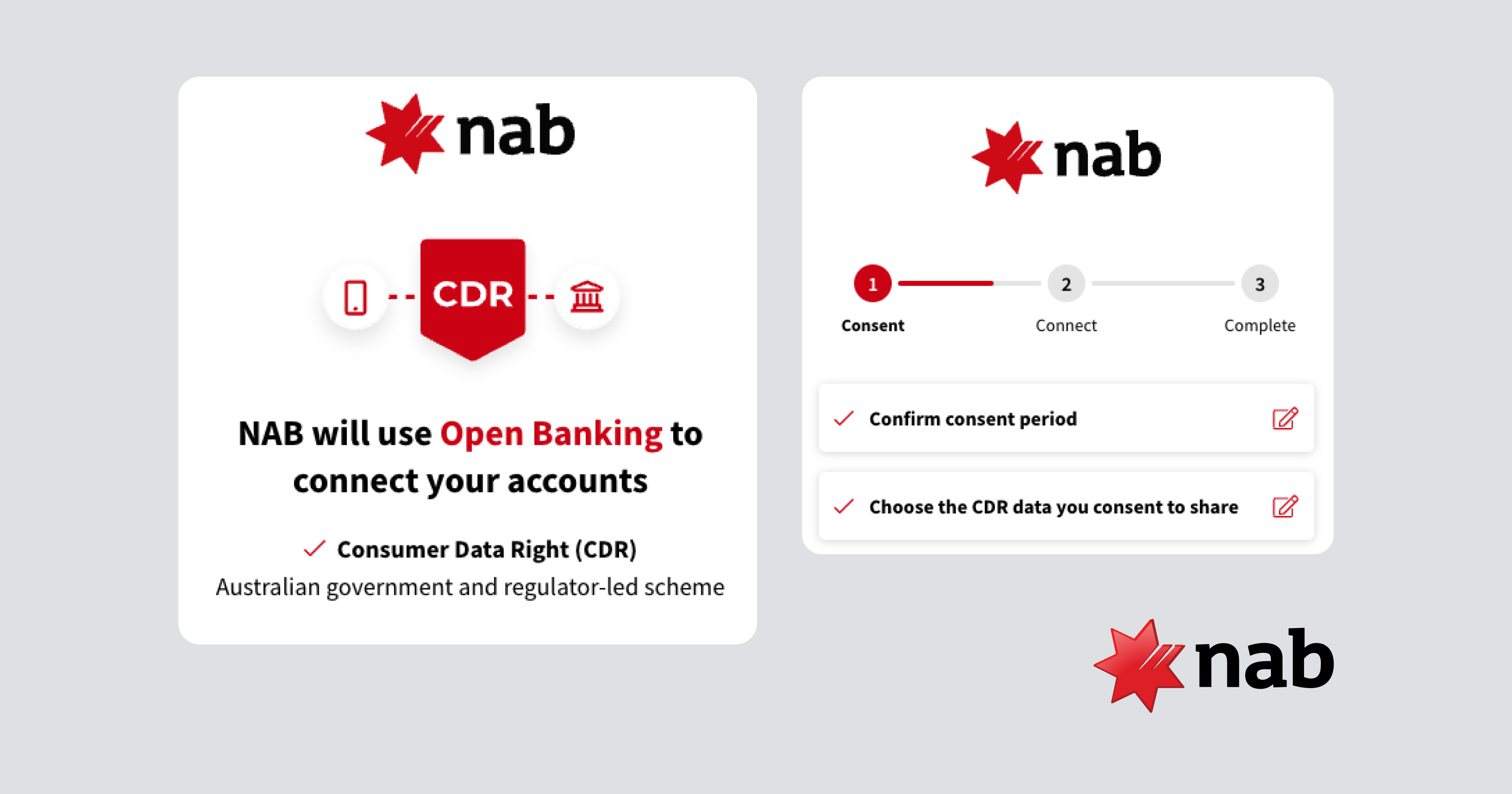

NAB

NAB uses Open Banking in a straightforward but logical way – to streamline its credit card application process. Customers can link their accounts to share their financial information, instead of manually uploading bank statements and payslips. This saves them and the bank time (and money).

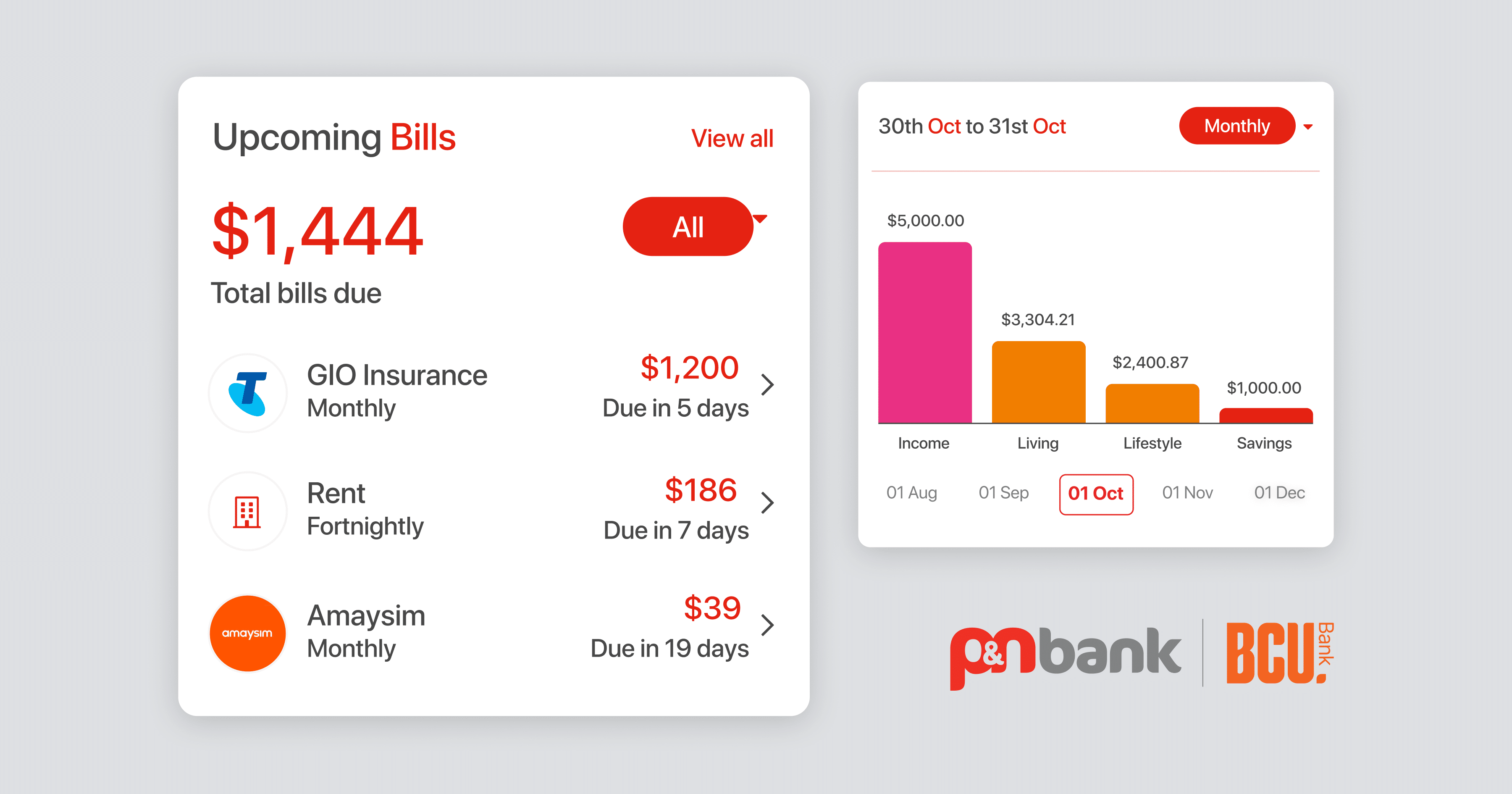

P&N Bank and BCU Bank

P&N Bank and BCU Bank both launched a Personal Financial Empowerment (PFE) app, mymo by P&N Bank and mymo by BCU. The apps allow customers to link accounts from other financial institutions to have a complete view of their finances all in one place. With smart insights built in, it helps customers understand their financial position and how they spend their money.

This article is part of ‘The State of Open Banking 2024’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Consumer Data Right industry and an overview of exciting new use cases.