Insights from early adopters

What a pleasure to be able to catch up face-to-face with you at industry events again! Earlier this month, we attended Intersekt, the Australian fintech conference, and last week we hosted a twilight panel discussion, ‘Open Banking – at the coalface’, at Hinchcliff House.

Our clients, partners and friends joined us for an evening of great conversation, insightful speakers and much enjoyed catch-ups! Below is a recap of the conversation (and here’s the tl;dr).

Our speakers on the night were:

State of the industry

Paul Franklin (Executive General Manager, Consumer Data Right, ACCC)

Panel

- Moderator: Jeniffer Harrison (Director, Reputation Edge)

- Josh Vernon (Co-founder & CEO, Wagestream)

Wagestream is a charity-backed financial well-being platform that works with employers - Simon Bednar (CEO, Finsure)

Finsure is a mortgage aggregator with 2,500 brokers around the country, focused on delivering a great, innovative broker experience - Wayne Matters (Deputy CEO, Beyond Bank)

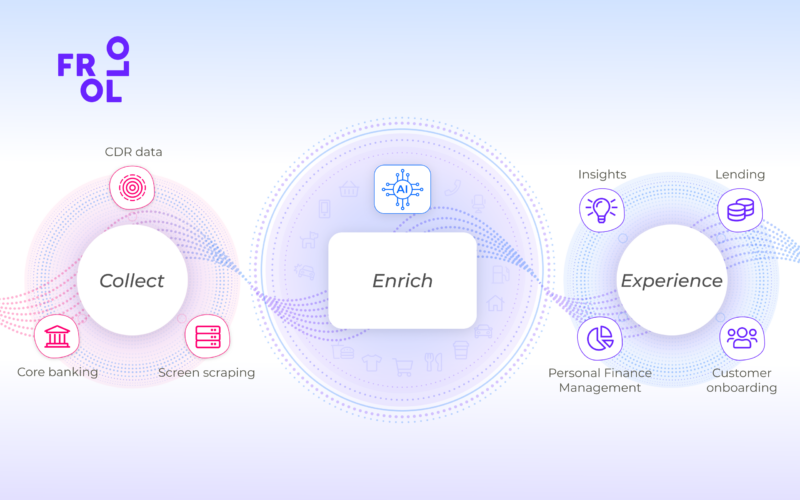

Beyond Bank is an Australian, customer-owned bank, announced the best bank in Australia by Forbes Magazine in 2022 - Simon Docherty (CCO, Frollo)

Frollo is the leading Australian Open Banking provider, supporting clients like Beyond Bank, Wagestream and Finsure

Open Banking builds trust and drives efficiency

As data-driven businesses, the panellists are excited about accessing financial data through the government-regulated Open Banking regime.

For us, it really came down to ‘what’s the most secure option, which gives the end user control?

Josh Vernon, Wagestream

We initially tried to use screen scraping to power our services. But, our customers are the likes of Hungry Jack’s, Accor, and the Reject Shop – large Aussie and global enterprises who expect our products to be built with security in mind. So for us, it really came down to ‘what’s the most secure option, which gives the end user the most control?’ ”

Similarly, for Finsure, it’s crucial that their brokers and lenders can rely on the financial customer data to make decisions. Using bank-verified data through Open Banking APIs would go a long way to stamping out fraud and mistakes. It also has significant efficiency benefits. Simon Bednar says: “When helping a customer apply for a loan, brokers have to continually key in the same information more than once. They have to key it in at the front, key it in when they get to our system, and then rekey it or verify it when they get to NextGen.

Open Banking means we can become much more innovative in the services we deliver to our brokers.

Simon Bednar, Finsure

So the idea of using Open Banking data, where you have a consistent set of data that can be relied on by all parties in the value chain, just means we can become much more innovative in the services we deliver to our brokers. It also means that we can provide decisions and opportunities for customers to be taken off the market quicker because the data set that is requested up front is the same one that’s relied on by the lender.

So for us, it’s a very important opportunity to streamline that process. “

The time to get started is now

Although we’re two years into the Consumer Data Right, any business going live with Open Banking today would still be considered an early adopter. But, according to our panellists and speakers on the night, the time to get started is now.

With over 100 banks sharing data for more than 30 financial products, the data to build an engaging use case is available. Open Banking now covers 99%+ of household deposits.

And even though there were some hiccups along the way, the speed and reliability of Open Banking data are second to none. Simon Docherty: “More than 98% of the API calls we make succeed the first time, and our platform has mechanisms to ensure the customer experience isn’t impacted in that 2% of cases. The speed at which we get the data is incredible; banks deliver us transactions in less than one second. Getting a full picture of your customers’ finances in real-time is a big step from emailing statements and manually deciphering them.”

We’ve spent a lot of money to build our Data Holder capabilities and ensure we’re compliant. So, we’re very keen to now use this investment to deliver value for our customers.

Wayne Matters, Beyond Bank

Beyond Bank, Finsure and Wagestream could all be considered early adopters of Open Banking, and they think it’s only logical to get started now. Wayne Matters: “We’ve spent a lot of money to build our Data Holder capabilities and ensure we’re compliant. So, we’re very keen to now use this investment to deliver value for our customers.

The conversation we had internally was around what we can do in this space and how quickly we can do it so that we can start to tap into the value that the CDR promises.

And the work we’re doing with Frollo now is around helping our customers to have a better understanding of their own financial situation. To help them with their financial well-being. Because we’re customer-owned and purpose-driven, that’s really where the value is for us.”

If you can be an early adopter and continually improve the experience, over time, that will allow you to build much more powerful and unexpected products.

Josh Vernon, Wagestream

The panellists agree on the value of going early and iterating. Josh: “We did have the conversation about whether we should wait or not. But what we learned from our experience with Open Banking in the UK is that if you can be an early adopter and continually improve the experience, over time that will allow you to build much more powerful and unexpected products.”

Tiered accreditation provides flexibility and lowers barriers to entry

The early adopters on the panel each travelled a different road to using Open Banking data. As one of the participants in the ACCC Open Banking trials, Frollo became Australia’s first fintech Accredited Data Recipient (ADR). As an unrestricted ADR, Frollo has the flexibility to work with ADRs, sponsor clients to become ‘Affiliates’ or ‘Representatives, or share data with Trusted Advisors.

Simon Docherty: “We work with many different clients, ranging from banks and fintechs to lenders, brokers and aggregators. As an unrestricted ADR, we have the flexibility to work with them through an accreditation model that best suits their business needs.”

[As a bank] all the hard work was in becoming an Accredited Data Holder and meeting our obligations there. Because of that hard work, there’s a streamlined process to become an ADR.

Wayne Matters, Beyond Bank

This flexibility can also work well for banks, who might want to have Representatives or work with Trusted Advisors. As Data Holders, they have a streamlined path to becoming an unrestricted ADR.

Wayne Matters: “All the hard work was in becoming an Accredited Data Holder and meeting our obligations there. Because of that hard work, there’s a streamlined process to become an ADR, which involves filling in an online form with the ACCC – which wasn’t too cumbersome – and talking to them about how we’ve met all their criteria and what we’re proposing to do as a data recipient. That’s a pretty easy process. Then, six weeks later, we received communication from the ACCC to say it’s been approved.”

The Representative model has become increasingly popular, especially with fintechs. Wagestream will initially become a CDR Representative of Frollo but might become an ADR in its own right at some point. Josh explained: “It’s just easier and cheaper to become a CDR Representative at the moment. I think we will become an ADR at some point, but right now we’re dipping our toes in the water and getting our users used to it. The CDR Representative model has really lowered the barrier to entry for us.”

What to do? Buy or build?

Businesses that are getting ready to use Open Banking have an important decision to make: Buy the technology, or build it yourself? What do you look for in a partner if you decide to buy?

“Although buy vs build was a big discussion for us, after chatting with many people in the industry, the answer became quite clear. There’s a Jeff Bezos maxim to focus on things that make your beer state better i.e. your core product. I don’t think it’s our core competency to build Open Banking connections, so we’re better off leveraging the expertise of the Frollo team.

And not to pat them on the back too much, but that’s really something awesome. We’re even using the technology from their B2C app, by integrating their SDKs into our own app. This is a B2C experience that tens of thousands of people have used, and we can just take this and put it in our environment. That’s invaluable for us in terms of just giving us a leg up.”

Where Wagestream is using Frollo’s SDKs in their own app, Beyond Bank has opted to whitelabel Frollo’s PFM (Personal Finance Management) app and launch it as a companion app to their banking app. Wayne Matters explains: “We’re not a very big bank, so we work with partners for most of our technology needs. So, when we made the call that we wanted to be a Data Recipient, the first choice was to partner with someone. We looked quite broadly around the market and who we might be able to partner with. Some of our key criteria were that the partner had to provide a functionally rich PFM experience, which was established and proven to work. Also, ideally Australia-based, because we like to support Australian-based businesses. Frollo ticked all of those boxes for us.”

The implementation process can get complicated when more vendors get involved. As Finsure already uses NextGen’s ApplyOnline software for processing mortgage applications, the existing integration with Frollo’s Open Banking platform proved extremely valuable. Simon Bednar: “The implementation experience has been very seamless for us. It’s quite unusual to use those sorts of words [such as seamless] when you’re working in technology because it usually costs more money and takes more time. So when my team came to me and said it’s going to take one week to deliver phase one from our perspective, I said that couldn’t be right. But it was, and that was only because of the teams at Frollo and NextGen teams and the work they did to make it possible.”

There’s a constant need to keep up with regulations and emerging opportunities. To make the most of these opportunities and not find yourself behind the eight-ball a year after you launched, you need an experienced partner to help you.”

Simon Docherty, Frollo

From a broader perspective, Frollo sees most of the market landing on the buy decision. Even banks that started going down the ‘build’ route have backed away and decided to buy. Simon Docherty: “It’s becoming much more common to use someone who’s a specialist in the field. It makes a lot of sense, especially in CDR, because it’s a regulated environment. There’s a constant need to keep up with regulations and keep pace with emerging data opportunities like energy, telco and action initiation. To make the most of these opportunities and not find yourself behind the eight-ball a year after you launched, you need an experienced partner to help you.”

Key takeaways from Open Banking – at the coalface

Three things we took away from the conversation:

- The time to get started is now – Banks, lenders, broker aggregators and fintechs are all getting ready to launch

- There’s an access model that works for you – Tiered accreditation has lowered the barrier to entry, and we’re now seeing CDR Representative, Trusted Advisor and Accredited Data Recipient used by different businesses. We can help you find out what works for you

- The right partner can make all the difference – Working with a partner that has extensive Open Banking experience and a proven, reliable solution enables you to focus on the customer experience

Thanks to our speaker, facilitator, and panellists, for their valuable insights, openness and effort, as well as to all our guests who made the time to come and engage in the conversation.

Please get in touch if you want further information about what was discussed during the panel or to chat with us about Open Banking powered solutions.