Accurately assessing income is essential for loan approvals, but it’s not always straightforward. Income isn’t just one static number; it fluctuates due to bonuses, unpaid leave, raises, and changes in work hours. These variations impact affordability and aren’t captured in a simple average. Context is key, and better income assessments save time and reduce risk.

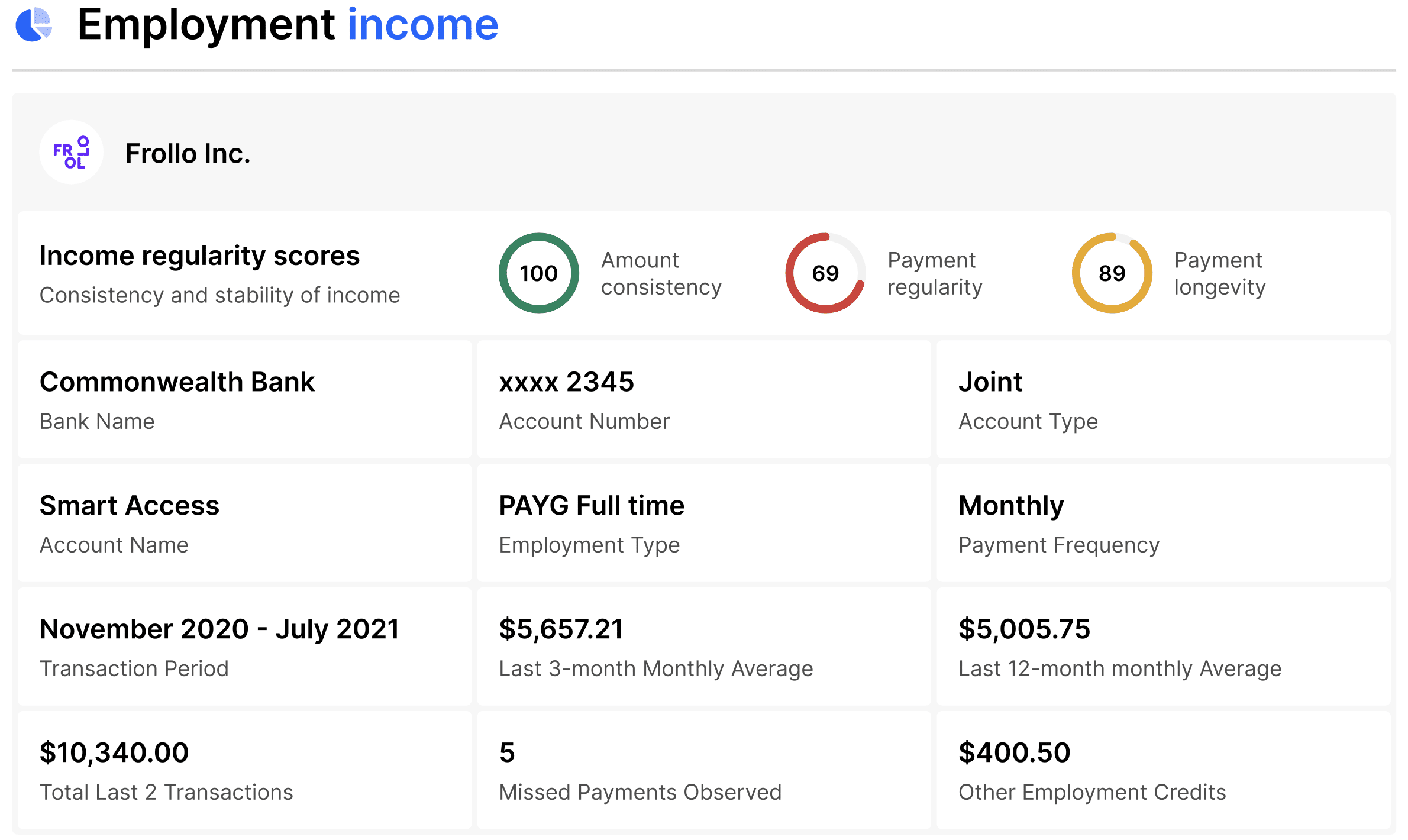

That’s why we’ve introduced Income Scoring in our Financial Passport. This new feature simplifies complex financial data into easy-to-understand metrics, aiding in income assessment. Our advanced AI models evaluate income on three critical dimensions:

- Amount Consistency: Measures the stability of employment income payments over time. A high score indicates stable employment, such as PAYG employment.

- Regularity: Assesses the regularity of income transactions based on the expected payment frequency (weekly, fortnightly, monthly).

- Longevity: Evaluates the duration of employment income over the reporting period of the Financial Passport.

Our AI ensures these scores are intelligent, accounting for expected seasonal changes (e.g., around December and July) and adapting to different employment types. Lenders can configure the scores to align with their risk tolerance thresholds for income verification.

Income Scoring enhances the Financial Passport by providing comprehensive, flexible, and accurate income assessments, helping lenders and brokers make better-informed decisions.

Learn more about the Financial Passport or get in touch to schedule a demo.